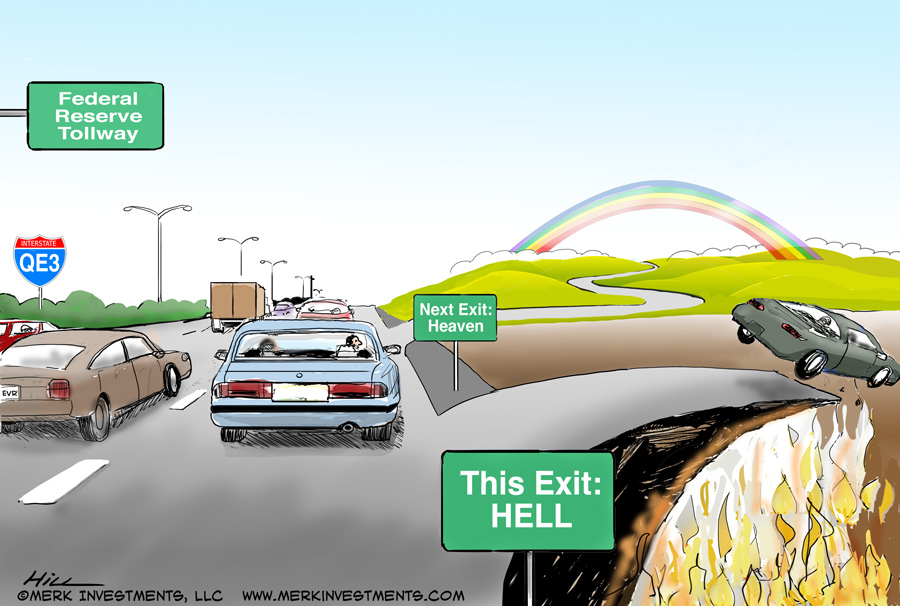

What's Your Exit?

Axel Merk, Merk Investments August 20, 2014 Are you prepared for an “exit”? If the Fed pursues an “exit” from ultra low interest rate policy, are you prepared for an exit from the stock market should things turn South? We discuss how investors prepare, noting the most common mistakes investors make along the way.

Are you prepared for an exit? No, you are not. We know because we meet investment advisers that have dropped their defensive strategies because they were losing clients. Those we meet that say they are prepared think they can get out at the right time should the markets topple over as the Fed exits; our guess is pigs will learn to fly before many will get that timing right. And those who don’t rely on luck are the first to tell us they don’t think they are fully prepared, as it’s rather difficult to predict how things will unfold. Should you prepare for an exit? There’s a group of investors that say an “exit” is ludicrous – there’s no way the Fed will pull off an exit. It turns out we sympathize with that view, but think getting ready for a Fed exit is still paramount. As I wrote in my book Sustainable Wealth, a prudent investor plans for different scenarios. Any scenario that has a non-negligible probability with a potentially profound impact on one’s portfolio should be taken into account. We don’t really have to go much further than this, as all we have to do is look at today’s market: in today’s markets, risk premia are highly compressed. This may sound academic, but what it means is that investors downplay the risk embedded in risky assets. We can see that through investors bidding up junk bonds and buying debt of weaker Eurozone countries. We can also see it in the stock market, where volatility is lower than what has historically been considered normal (i.e. the VIX index is at an unusually low level). In plain English, this means markets may be priced to perfection. And that’s where the problem is: the world isn’t perfect. As such, just the hint of a Fed exit might cause havoc in the market, even if it is never actually pursued. Please read ‘Instability the New Normal’ for an in-depth analysis on how this may unfold. Five common mistakes investors make The much more difficult question is how does one prepare in earnest for an “exit.” After all, any strategy not fully invested in the stock market appears to have under-performed. What not to do is a lot easier to say than what to do. Five common mistakes investors make:

How do you prepare for an exit? All successful investment strategies I have encountered have in common that they are based on a plan. A plan that takes into account where one comes from, where one is planning to go; how one intends to get there, with appropriate checks along the way. If this sounds obvious, you would be surprised how few are adhering to these basic principles. And why would I mention these basic principles in the context of a Fed exit? Two reasons: first, one should not lose sight of basic investment principles in addressing any one situation; and second, the best of plans are impacted when others are not living up to their part of the bargain. What I’m referring to is that the Fed – which arguably has a profound impact on asset prices – does not appear to follow those basic principles in conducting monetary policy. The only thing we really know about the Fed’s so-called exit is that Janet Yellen would like to keep monetary policy accommodative to help the convicted felons get a job (as discussed in her first policy public speech since becoming Fed Chair). This characterization may sound unfair, but it’s the simplistic conclusion I have to draw when given her focus on employment, her expressed desire to help ‘Main Street,’ the fact she has never pushed back when being labeled a dove, and her rejection of a rules-based framework to monetary policy. That said, let’s address these basic principles in the context of an exit: Where we came from: This did not start in 2007 or 2008, but has long been in the making. For in-depth analysis over the past 10 years, please read up on our Merk Insights. For purposes of today, we shall note that investors were burned in 2000, as well as in 2008; wages for many have stagnated. We have endured years of low interest rates, making it difficult if not impossible for many pensioners to live off the income generated by their fixed income investments. Many investors have moved to embrace a riskier mix of investments than they are comfortable with, but stick with their allocations as long as they don’t get burned. To us, this increases the odds of a crash, as those investors may not stick around when the going gets rough. However, we know a few things about this journey: geopolitical tensions have been rising. In ‘Instability the New Normal’, we argue that this is a symptom of the times as policy makers blame minorities, the wealthy, and foreigners when they have trouble balancing the books; rarely ever do they blame themselves. Government deficits are not sustainable; yet, there might not be enough wealthy to tax, either. In that environment, central banks may be pressured to keep rates lower for longer; in fact, we recently argued we might see negative real interest rates for years, even as nominal rates may rise. In a best-case scenario, as we have seen in recent years, this may inflate asset prices, but it may be foolish to base one’s long-term outlook on such gains to continue. Instead, financial repression may persist. We live in an environment where both government and consumers are heavily indebted, with foreigners owning much of the debt, creating the perverse incentive to debase the value of the debt (through inflation or a weaker currency) to have foreigners that don’t vote hold the bag. As someone with savings, don’t trust your government to take care of you. This applies whether you are based in the U.S. or many other countries. You are on your own. How to get there, with appropriate checks: If you just avoid the five mistakes listed above you are already in much better shape than most to achieve your goals. Checking one’s progress applies during good as well as during bad times. When times are rough, remembering one’s priorities (to cut back on unnecessary expenses, continue putting money aside for key goals) is important. When times are good, it’s important to take chips off the table, to rebalance one’s portfolio. At times, I see investors be reasonably diligent about choosing an investment, but then fall into the trap of justifying one’s investment at any cost. A good cross-check of whether to keep an investment is whether the conditions that lead one to invest in the first place persist. Meaning, if one buys company ABC because of good management, then reflect on whether management is still good. If one buys it because of great earnings momentum, well, are earnings still growing? If one buys it because it was cheaper than its peers based on some metric, then, you guessed it, does that still apply? As you might imagine, buying a stock – or ETF - because some pundit recommended it on TV is a bad idea, as you are unlikely to be around when he or she changes his or her mind. A great way to check one’s portfolio is to have it stress-tested against different scenarios. A great temptation in today’s social media driven world is to only listen / like / follow folks one agrees with. But to make a market, we need disagreement amongst voluntary participants. A key reason we publish so much is to engage the public in an effort to receive feedback, so that we can consider viewpoints we might have ignored. An extreme example of that was in the summer of 2012 when we published the Merk Insight ‘Draghi’s Genius’; we did not change our mind upon receiving an avalanche of disapproval, but it kept us on our toes. Similarly, we encourage anyone to look beyond their circle of friends to get out of their comfort zone when it comes to testing investment ideas. Putting it to work Just as former Fed Chair Bernanke was talking about his toolbox, investors may want to consider assembling their own tools to navigate what’s ahead. Note:

We have a webinar coming up discussing in more detail and more specifically what investors can do to prepare themselves for a potential Fed exit from the ultra-low interest rate environment. Please register to be notified of our upcoming webinars. If you haven’t done so, also make sure you sign up for Merk Insights. If you believe this analysis might be of value to your friends, please share it on your favorite social media site. Axel Merk Axel Merk is President and Chief Investment Officer, Merk Investments,  Follow @AxelMerk Tweet Follow @AxelMerk Tweet

|