Merk 2016 Outlook: Markets, Dollar, Gold

Axel Merk, Merk Investments December 2, 2015 Up! Buy the dips! What could possibly go wrong? A hell of a lot, actually, so investors might want to take precautions before, rather after, bad things happen to one’s portfolio. We take a stab at where one may find opportunities in 2016. In an early August Merk Insight entitled Coming Out - As a Bear!, we argued rising “risk premia” could create headwinds to the stock market (and other so-called risk assets) for at least eighteen months, if not years. To understand what this means, consider that central banks have - in our view - taken fear out of the market, as evidenced by low yielding junk bonds and low volatility in the stock market, amongst others. The lack of fear in risky assets is another way of saying that risk premia have been low, or as we also like to put it, that complacency has been high. Not fully appreciative of this inherent risk, it seems many investors have refrained from rebalancing their portfolios, and bought the dips instead. We believe the Fed’s efforts to engineer an exit from its ultra-low monetary policy should get risk premia to rise once again, that if fear should come back to the market, volatility should rise, creating headwinds to ‘risky’ assets, including equities. That said, this isn’t an overnight process, as the ‘buy the dip’ mentality has taken years to be established. Conversely, it may take months, if not years, for investors to shift focus to capital preservation, i.e. to sell into rallies instead. When we talk with retail and institutional investors alike, we hear that many like neither stocks nor bonds, but that they haven’t changed their investment strategies. The fear of losing out on the next rally appears to still be high. Yet, when we look at other parameters in the market, we can’t help but be pessimistic:

It’s no secret that the U.S. economy has not been firing on all cylinders; the global slowdown appears to have hit the U.S. as well, as we see, amongst other factors:

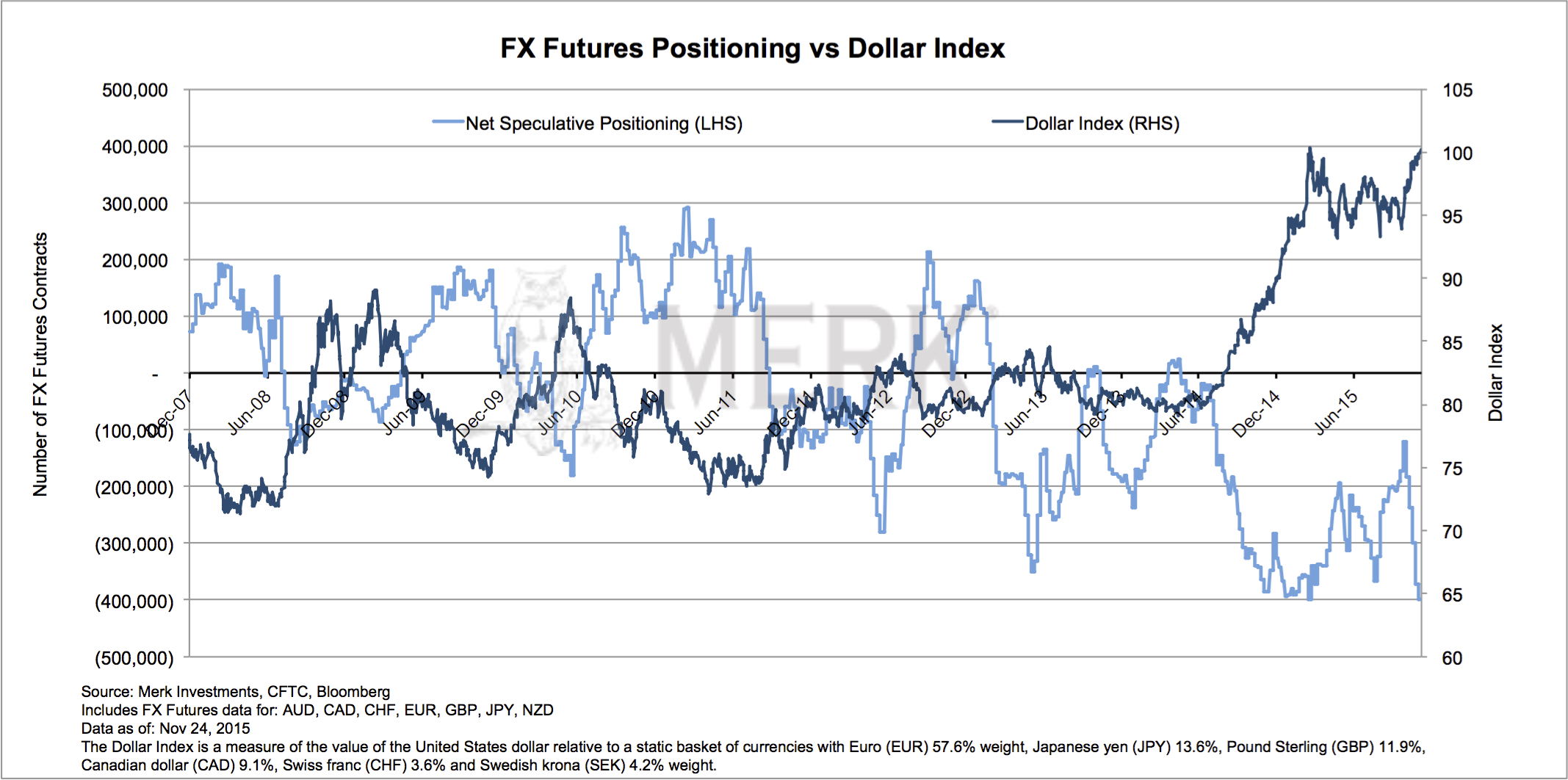

All of this unfolds despite low energy prices that, theoretically, should boost consumer spending. As ‘risky assets’ (most notably the equity markets, but also the high yield fixed income market, amongst others) in general have benefited from the low interest rate environment, those may be most at risk. When it comes to ‘systemic fallout’, i.e. the collapse of an institution, we don’t expect a major bank to fail. However, while regulations in recent years have coerced banks to take on less risk, such risk has moved to the shadow-banking sector. And while regulators have made the financial system more robust against some shocks they can imagine, we imagine any shock is more likely to come from places were we don’t expect it; more importantly, it may come from a place where the Fed might not be able to provide relief. Market jitters a few months ago because of losses at Glencore PLC, an Anglo-Swiss trading and mining company, come to mind as a possible candidate for turmoil in the market. Turmoil in a Chinese brokerage firm or some other obscure place could also be a source for trouble in the markets. It wouldn’t be the first time that the Fed is raising rates into a slowing economy. So where should investors hide, or better yet, make money? First, let me mention that there’s no assurance that risky assets may indeed plunge. The buy the dip mentality has proven profitable for many investors, and it may well continue. But even investors that are very optimistic about the market may want to do a thorough stress test on their portfolio. At a recent conference, an “investment coach” explained how investors are diversified across tens of thousands of stocks with a global stock portfolio, suggesting nothing could possibly go wrong. We beg to differ. We see diversification as creating a portfolio with underlying assets that aren’t highly correlated with one another. That’s no small feat in an environment where the prices of so many assets have moved up in tandem. Alternative strategies Take a long/short equity strategy, for example. Such a strategy, if well executed, may deliver just what the doctor ordered. However, in such a strategy, the portfolio manager can also be wrong on both the long and the short side, so no assurance can be given that it will deliver. The same applies to long/short currency strategies. Buying the Australian dollar versus the New Zealand dollar (or vice versa) is all but certain to generate returns that have a low correlation to other assets, but it provides no assurance that gains will be generated. Let’s get more specific about some areas: Got gold? Got cash? Let’s talk dollar...

What about that euro? Similarly, as the European Banking Authority (EBA) points out in a recent report, European banks continue to carry €1 trillion of non-performing loans, holding back their ability to lend. Again, printing money won’t fix that. In the aftermath of the terror attacks in France, the Vice Chair at the ECB indicated monetary policy could be used to combat the economic fallout, if there is to be one. We aren’t convinced that a bazooka of fiat money can effectively be deployed to fight hard bullets. The reason - or excuse - to keep rates low is low inflation. Just be aware that a key reason why inflation is so low is because of the plunge in commodity prices. That plunge accelerated after OPEC’s surprise announcement not to cut production on Thanksgiving Day in 2014. That’s just over a year ago, suggesting that the year-over-year comparisons on commodity prices may not much longer reflect a steep decline. That is, a key argument for Mr. Draghi’s strategy may fizzle out. We mention all this because we think it is unsustainable. Mr. Draghi is deploying not only the wrong medicine for the disease, we believe he is trying to coerce the euro lower to help boost exports. Never mind that the key beneficiary is Germany, an economy that’s not in need of further stimulus. More importantly, we believe it’s rather difficult to coerce a currency backed by an economy with a current account surplus lower through monetary policy. We have noted that the euro has incidentally performed very well in risk-off environments. Our explanation is that the currency is used as a funding currency, i.e. when investors feel good, they borrow money in euros; conversely, they reduce their leverage when volatility rises, thereby pushing the euro higher as positions are unwound. It’s doubtful the euro can thrive merely on short-covering rallies, but there’s a limit as to how long the euro can be suppressed. Sweden... Commodity currencies What about implications of the IMF’s decision to declare the Chinese yuan a ‘reserve currency? Well, to continue this discussion, please register for the Merk 2016 Outlook Webinar on Thursday, December 10. If you haven’t already done so, ensure you don’t miss it by signing up to receive Merk Insights. If you believe this analysis might be of value to your friends, please share it with them. Axel Merk Axel Merk is President & CIO of Merk Investments  Follow @AxelMerk Tweet Follow @AxelMerk Tweet

|