What is an Efficient Frontier?

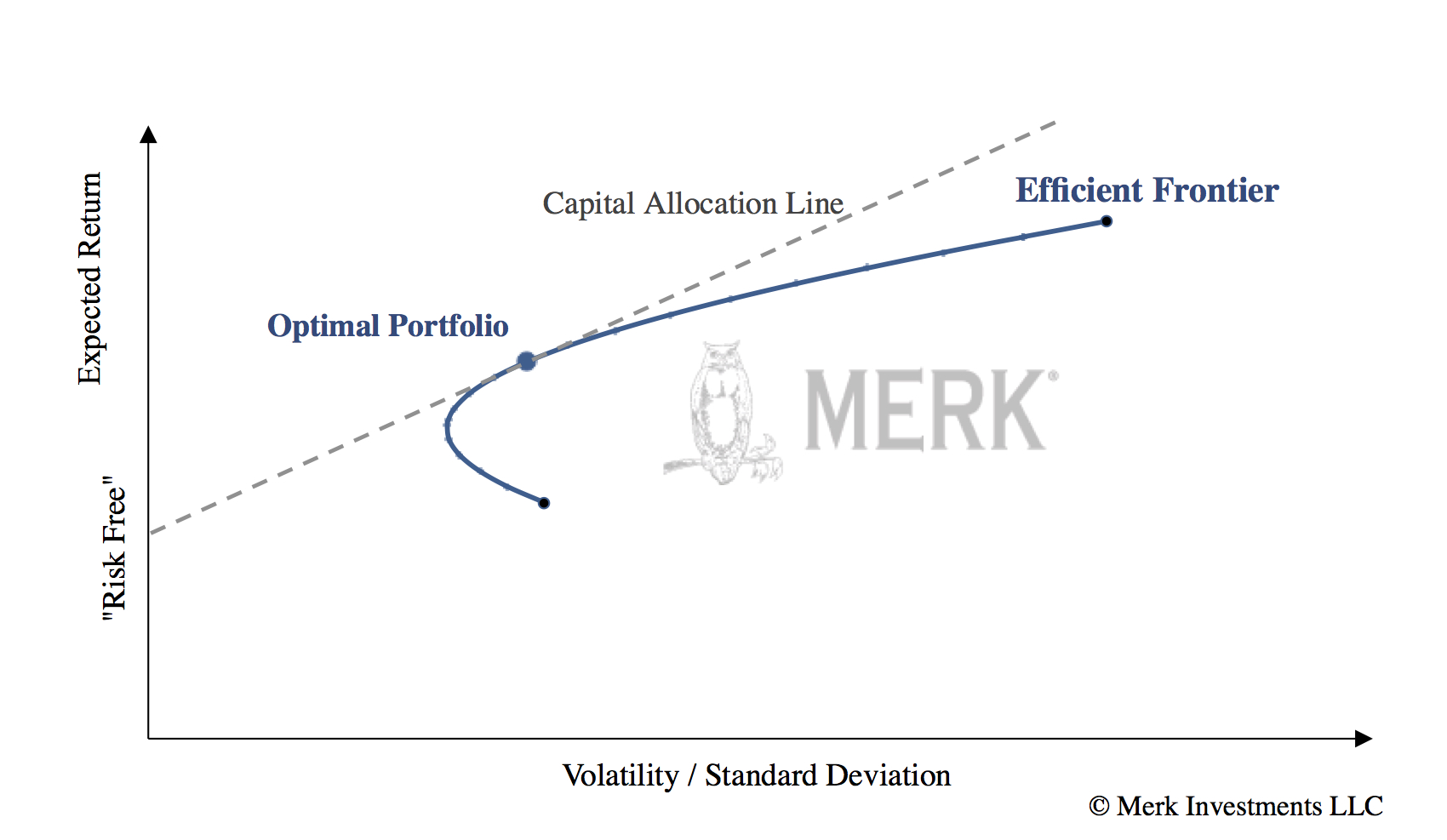

An efficient frontier is a set of optimal portfolios that offers the highest expected return for a defined level of risk or the lowest risk for a given level of expected return. Portfolios that lie below the efficient frontier are sub-optimal, because they do not provide enough return for the level of risk. Portfolios that cluster to the right of the efficient frontier are also sub-optimal, because they have a higher level of risk for the defined rate of return. The Capital Allocation Line is a line of all possible combinations of risky and risk-free assets. The risk-fee rate represents the interest an investor would expect from a risk-free investment over a specified period of time.

|