TIPS - A Misunderstood Inflation Hedge Nick Reece, CFA & Axel Merk

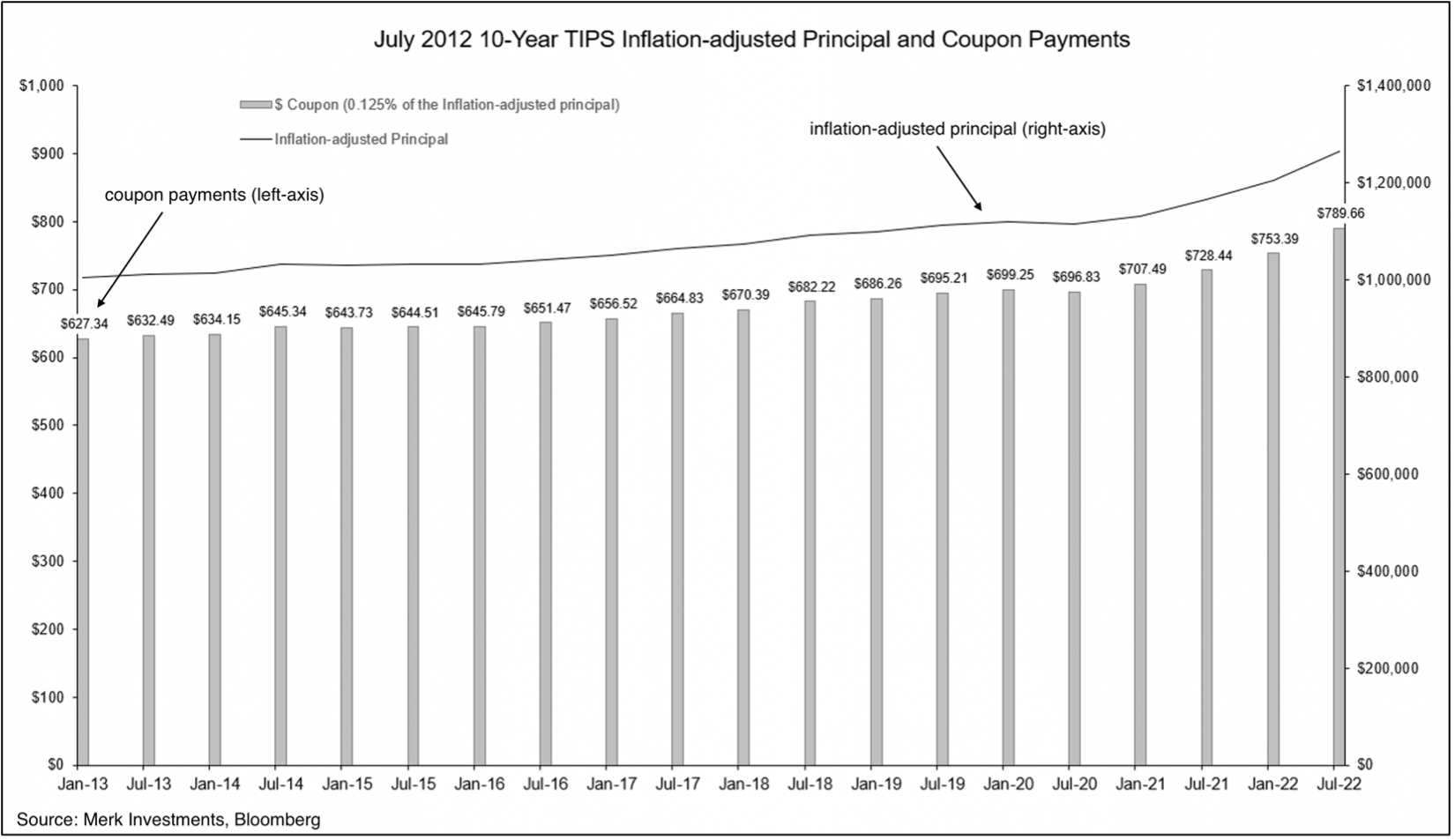

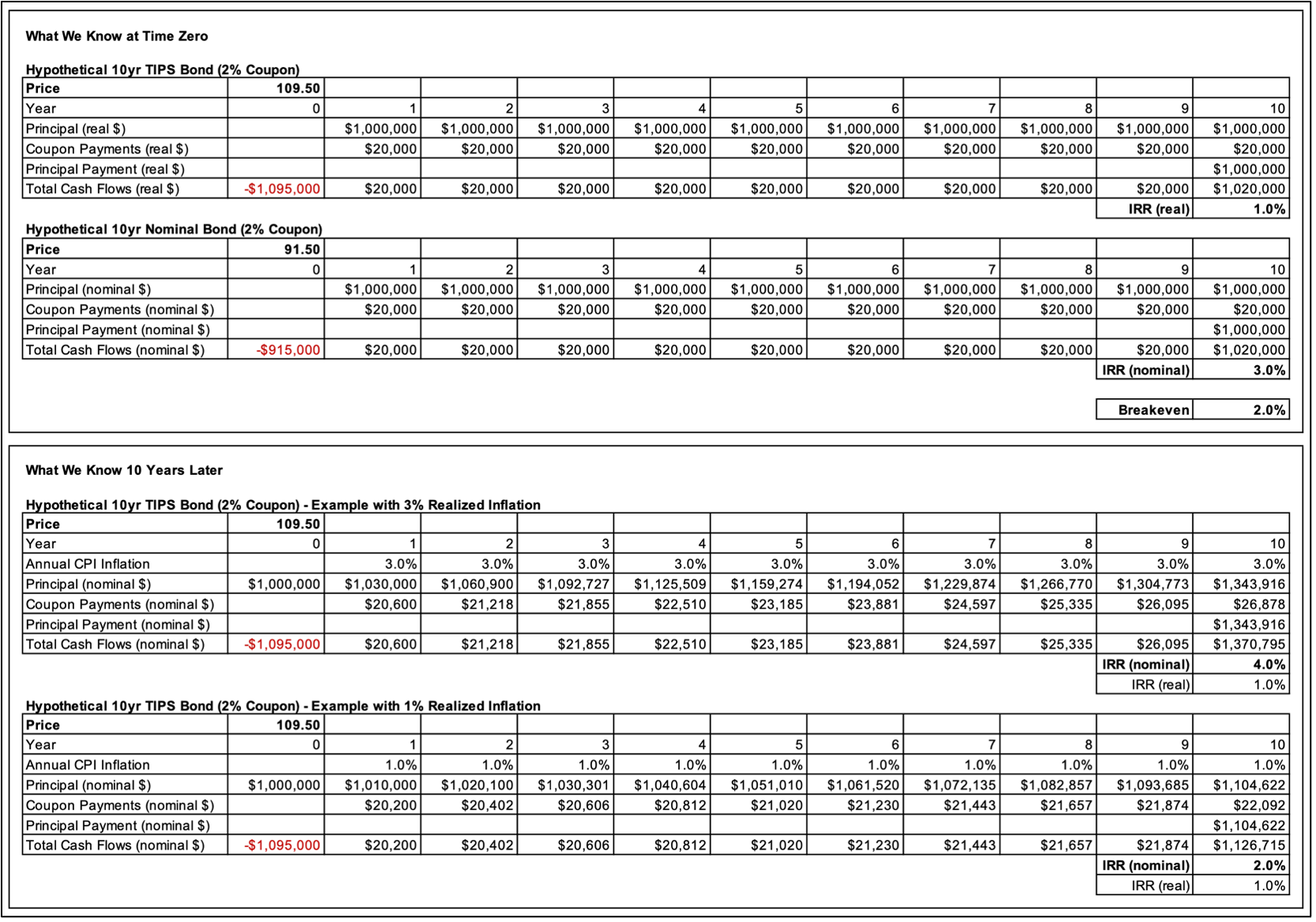

September 28, 2022 With inflation high and volatile, and with uncertainty about how quickly inflation might return to pre-Covid levels, should investors consider Treasury Inflation Protected Securities (“TIPS”) as part of a conservative portfolio allocation or for portfolio diversification? To answer the question, it is helpful to understand what TIPS are and how they work in practice. As a quick introduction, the yield of a TIPS bond is called the “real yield” or “real rate” because it represents the rate of return after inflation. Traditional Treasuries are referred to as “nominal bonds,” to distinguish them from TIPS, as their yield is in nominal terms rather than inflation-adjusted terms. The difference between the yield of a TIPS bond and a nominal Treasury bond of comparable maturity is a market-implied measure of inflation expectations referred to as the “breakeven” rate. It is the rate of inflation that would make the returns of the two types of bonds equivalent. Between real rates, nominal bond yields, and breakevens, there can be confusion about what is what. Some market participants might hear of the concept of real rates and think that real rates are only real to the extent that breakevens turn out to be an accurate forecast of realized inflation. In other words, some might primarily conceptualize real rates as nominal interest rates minus inflation expectations, be skeptical of inflation expectations, and therefore be skeptical of the idea of real rates. That is true for investments in nominal bonds, but not for investments in TIPS. To clarify any potential confusion, if the real rate is +0.5% at the time of purchase, TIPS will return half a percent more than whatever inflation is, regardless of what inflation expectations were at the time of purchase. For example, if inflation turns out to be 1% per year, TIPS will return 1.5% per year. If inflation turns out to be 7% per year, TIPS will return 7.5% per year. The real rate (i.e., the rate of return after accounting for changes in purchasing power) will be +0.5%. To reiterate, real rates are returns relative to realized inflation, irrespective of inflation expectations. How TIPS Work: The below chart shows the inflation-adjusted principal and the coupon payments on a $1,000,000 face value TIPS bond that matured in July 2022. The bond paid a 0.125% coupon semi-annually. Simplified Examples—Illustration of Hypothetical TIPS The first table above shows a hypothetical TIPS bond with a real rate of 1% at the time of purchase (i.e., “IRR (real)”). In other words, 1% is the yield to maturity in real (inflation-adjusted) dollars. The second table shows a hypothetical nominal bond with a yield to maturity at time of purchase of 3% (i.e., “IRR (nominal)”). Comparing the TIPS bond and nominal bond, the breakeven rate at the time of purchase is 2% (the 3% nominal bond yield minus the 1% real rate on the comparable TIPS bond). The third table shows the nominal cash flows and rate of return if inflation materializes at a pace of 3% per year. The fourth table shows the nominal cash flows and rate of return if inflation materializes at 1% per year. In both cases, the real rate of return is 1%. In the first case, nominal returns are 4%, minus 3% inflation leaves a real rate of 1%. In the second case, nominal returns are 2%, minus 1% inflation leaves a real rate of 1%. At time zero (i.e., the present moment in time) we know what the real return will be on the TIPS bond and we know what the nominal return will be on the nominal bond. We do not know what inflation will be. One possible future outcome is that inflation runs at 3%. Another possible future outcome is that inflation runs at 1%. The future is unknown, but we know the inflation expectation (i.e., the breakeven rate) and we can have an idea of our own inflation outlook and inflation risk assessment. We can ask ourselves, is inflation risk skewed to the upside or downside relative to the breakeven rate? If inflation materializes above the breakeven rate, the TIPS bond offers a better return (4% nominal and 1% real vs. 3% nominal and 0% real). If inflation materializes below the breakeven rate, the nominal bond offers a better return (3% nominal and 2% real vs. 2% nominal and 1% real). Simply put, if inflation comes in higher than expected, TIPS provide higher returns. If inflation comes in lower than expected, nominal bonds provide higher returns. The breakeven rate is useful for comparing market-implied inflation expectations to one’s own inflation expectations. If you think inflation will materialize above the breakeven rate, or that there is a high risk that inflation might materialize above the breakeven rate, then TIPS might be a better investment allocation compared to nominal Treasury bonds. As of writing (September 2022), the 10-year breakeven rate is about 2.3%. If inflation comes in below breakeven, the TIPS will usually still make money in nominal terms, just not as much as the nominal Treasury bond. However, sometimes real rates are negative. In such cases, to make money in absolute, nominal terms, inflation would need to come in at a rate that offsets the negative real rate. For example, if the real rate is -1% at the time of purchase, inflation must be at least 1% to make money in nominal terms, if the bond is held to maturity. Interest Rate Risk For investors holding to maturity, price changes due to interest rate volatility are merely fluctuations along the way. When held to maturity, Treasuries will pay out as expected regardless of what happens to interest rates along the way—in real terms with respect to TIPS and in nominal terms with respect to nominal bonds. Primer on Bond Math Breakeven Rates However, as noted, confusion can arise when real yields are described as “nominal yields minus inflation expectations (or breakevens).” That might imply that the real yields are reliant on inflation expectations being accurate. But real yield is the inflation-adjusted yield received by the TIPS investor regardless how inflation materializes. The real return is the nominal return for a constant CPI price level. To reiterate with another example, if the real yield at purchase is 1%, the nominal yield received will be 5% if inflation is 4% and 2% if inflation is 1%. If it is the latter and inflation expectations at the time of purchase were 2%, the investor would have been better off in nominal bonds than in TIPS. However, the investor may not have wanted to take the risk of inflation being higher than 2%. If the breakeven rate turns out to be accurate, then investing in a nominal Treasury bond and a TIPS bond are equivalent. However, in our analysis, breakeven rates have little predictive power. In other words, inflation is likely to come in differently than the market had expected. For example, five years ago (July 2017), inflation was expected to annualize at 1.7% over the subsequent five years, and it has actually annualized at 3.9%. So, TIPS protect against upside inflation surprises. Currently (September 2022), five-year breakeven rates are about 2.7%. That means that inflation is expected to run at 2.7% on average over the next five years. Investors need to weigh their own expectations versus what is priced into markets when considering an allocation to TIPS versus nominal bonds. Because upside inflation surprises typically hurt traditional stock and bond portfolios (e.g., the “60/40” portfolio), TIPS can serve an important diversifying function. Breakeven rates are derived from the difference between the nominal bond yield and the TIPS yield, but conceptually one could think about inflation expectations as an independent variable. To the extent nominal yields are unchanged and inflation expectations move higher, TIPS will appreciate in value (because real rates will fall). However, if inflation expectations rise and nominal rates rise more than inflation expectations, TIPS will decline in value as real rates rise. The simple bond math is that as yields increase, prices decrease. Higher inflation expectations are usually not a negative for TIPS prices, but if they are accompanied by higher real interest rates, TIPS prices will decline—at least temporarily. If held to maturity, TIPS will pay their stated real yield at the time of purchase. Over long periods of time, TIPS have delivered on their raison d'être of providing inflation protection. Some lament that TIPS have not performed well over the past six months (March 2022 – Sep 2022). The US inflation rate has remained high and yet the total return on TIPS has been negative. The reason is the change in real rates. 10-year real rates have moved from about negative 1% to positive 1%. However, the silver lining is that at positive 1%, forward-looking return prospects are much more attractive now (Sep 2022) than they were six months ago (March 2022). TIPS Track Record Conclusion TIPS have historically been a good inflation hedge over a medium to longer-term investment horizon. Yet interest rate risk and related volatility mean that TIPS do not always behave as some investors might expect over shorter time horizons. While the history is limited (TIPS were only introduced in 1997), the record suggests that TIPS may provide valuable diversification benefits in both inflationary and recessionary environments. Additionally, with real rates in positive territory as of writing (September 2022), and closer to the high of the range over the past decade, TIPS offer positive real returns on a forward-looking basis if held to maturity and may provide shorter-term price appreciation potential from a move lower in the real yields from current levels. When comparing TIPS to nominal bonds, we need to consider breakeven rates. As of September 2022, the 2-year breakeven is 2.3%. That means the market expects inflation to average 2.3% over the next two years. Do you think inflation will be higher or lower than that? This analysis of TIPS is meant to serve as an introduction and to clarify some potential misunderstandings and does not address all aspects of investing in TIPS. Please feel free to reach out directly with any questions: www.merkinvestments.com/about-us/contact-us Nick Reece & Axel Merk 1: TIPS Index = Bloomberg US Treasury Inflation Notes Total Return Index

|