Strategic Minerals: Spike in Demand?! James Holman

March 8, 2023 If the auto companies hit their EV targets, we may be in the early innings of a spike in demand for many commodities. The last twelve months have strengthened our view that metals could be a significant bottleneck in the clean-energy transition. The war in Ukraine further solidified the resolve of the West to find alternative sources of energy and reliable sources of raw materials. Strained relations between the US and China have made it a bipartisan issue to find friendly supplies of minerals critical to our economy. As most of the major car manufacturers have committed to electrifying their fleets, it appears there is no turning back on the global auto industry going electric. Below is a compilation of news from recent months which we believe illustrates the scale of the industrial rewiring the clean-energy transition will entail. These also highlight the importance of securing sources for the necessary minerals. Please note that the articles listed below are the opinions of the authors and are provided for information purposes and do not necessarily reflect my opinions nor the opinions of Merk Investments; emphasis may have been added in quoted text. Industry News

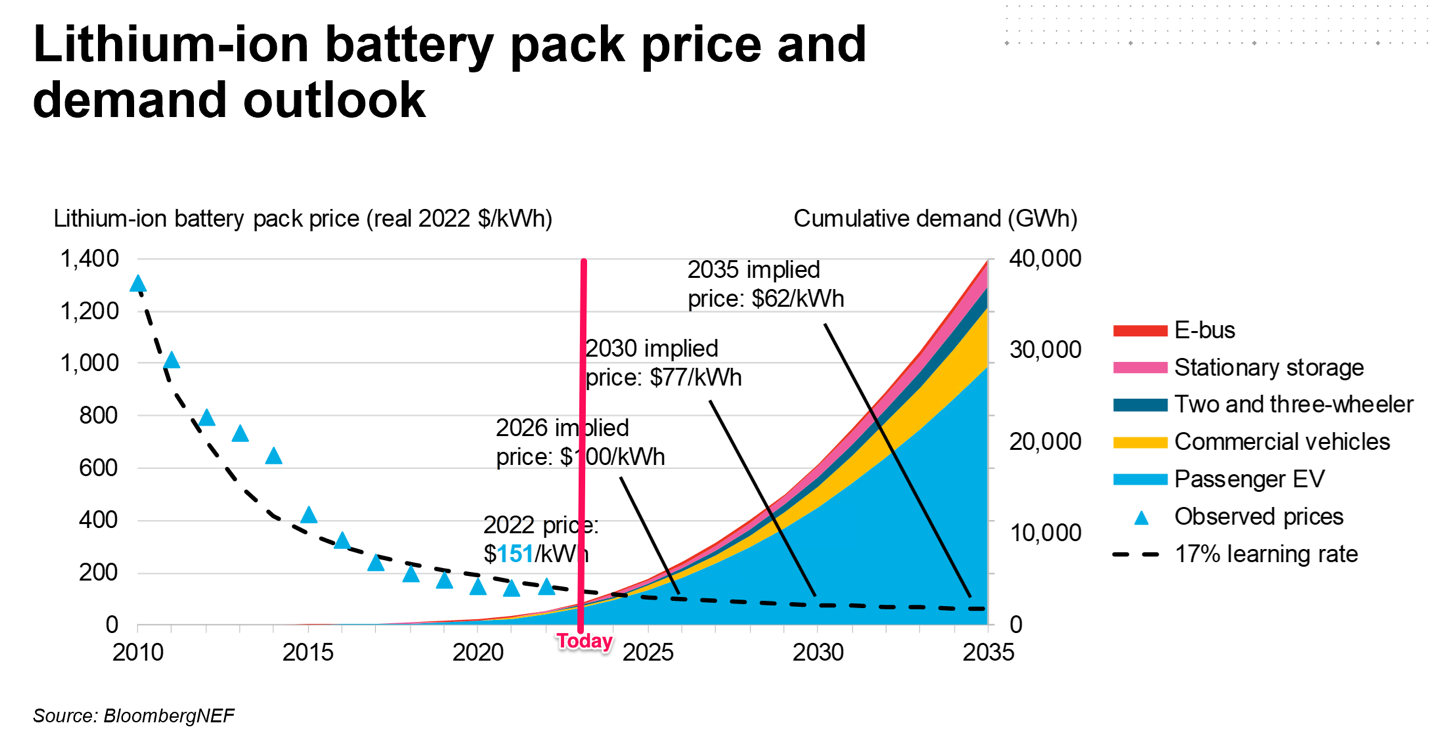

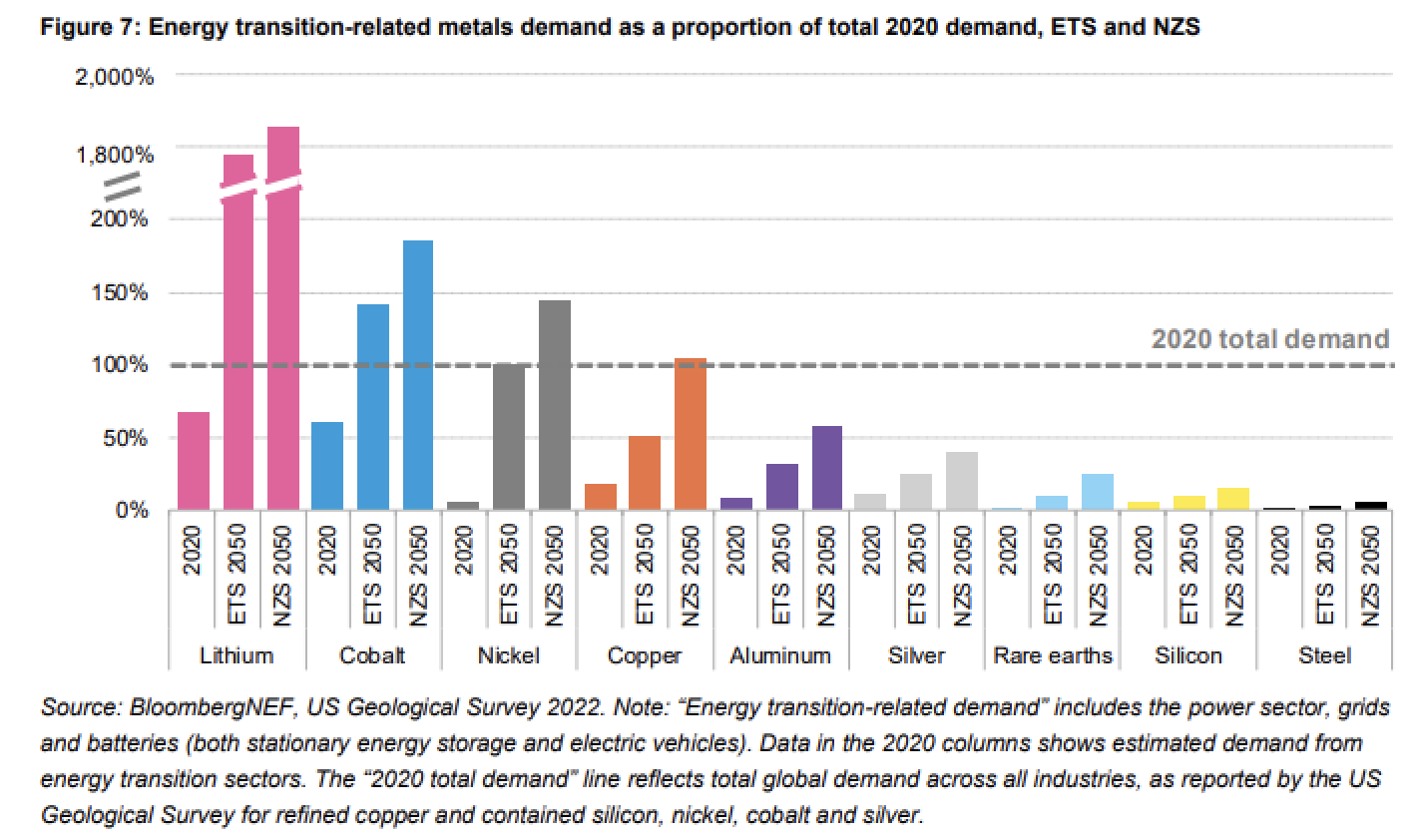

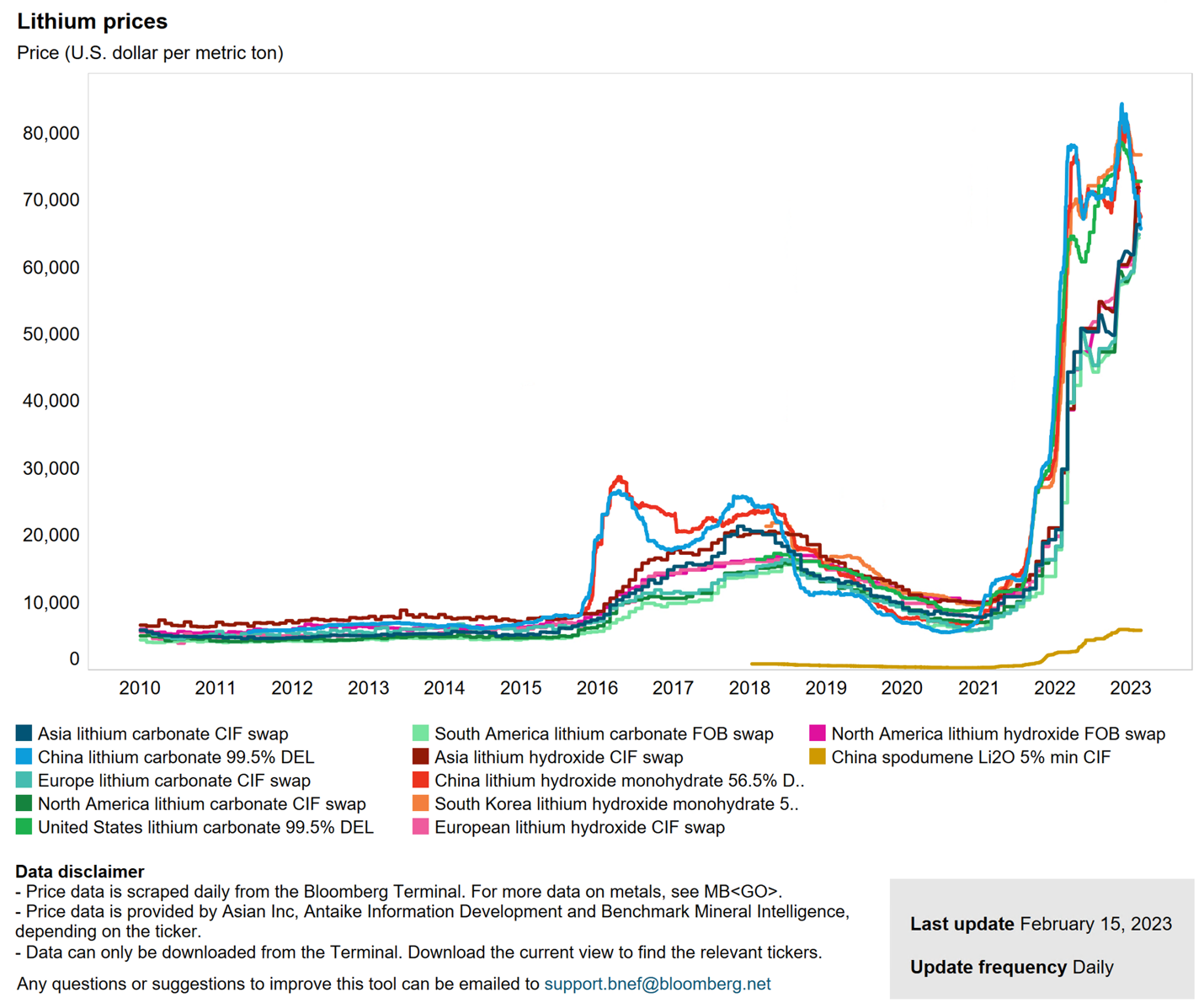

Kwasi Ampofo, head of metals and mining at BloombergNEF: “The energy transition has put a spotlight on raw materials. It presents an opportunity and a responsibility as well. Responsible mining must underpin the extraction of the resources needed to meet this demand. Mining is the bedrock of the energy transition, hence, the industry must lead the way, by first decarbonizing its own footprint.” The chart below, taken from the BloombergNEF article, demonstrates the global economy is in the early innings of the energy transition. The authors suggests that there will be ample and cheap sources of raw materials. Measurements are as of the end of 2022: A twitter thread I wrote on this subject: From the article linked to in my tweet: “…global shortages of the metal may reach eight million tonnes by 2032, as soaring demand continues to offset new projects numbers.”

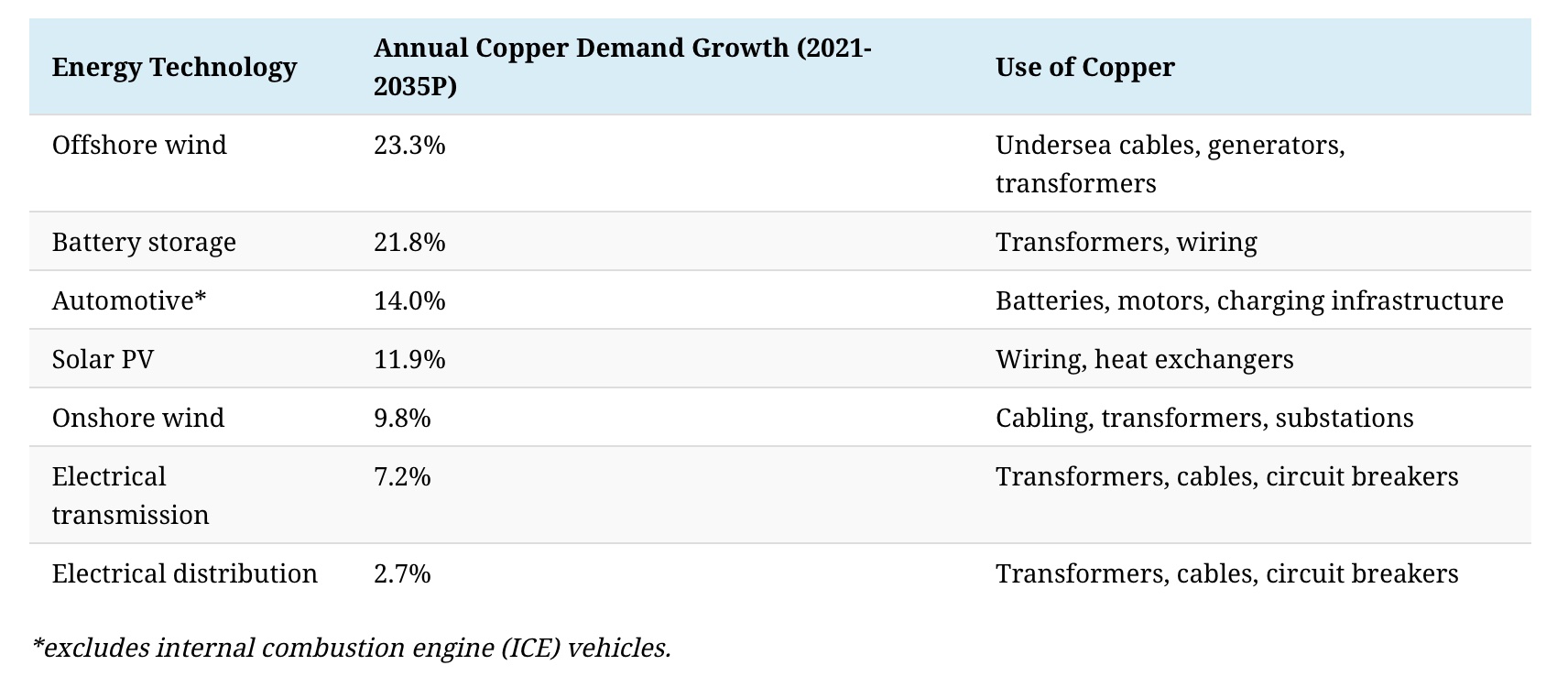

Taken from the article, a table as to copper’s role in energy technologies:

This is an extensive report put out by S&P with Daniel Yergin as one of the contributing authors. Mr. Yergin is likely best-known for writing “The Prize,” which may be the most famous history book on the petroleum industry: “Copper -- the "metal of electrification" -- is essential to the energy transition. But could a looming mismatch between available copper supply and future copper demand present challenges to the achievement of Net Zero Emissions by 2050 goals?”

“Replacing the existing fossil fuel powered system, using renewable energy technologies, for the entire human population is even more enormous task than thought, reveals the report made by Associate Research Professor Simon Michaux from Geological Survey of Finland GTK. Required extra energy and materials may form a bottleneck even if we could reduce consumption and material needs via circular economy and regulation.”

“New energy systems—SLB is focusing on creating and scaling the new energy systems of tomorrow. With its New Energy business evolving to a strategic driver for the company, SLB will continue forging partnerships across various industries to develop technologies across five areas: carbon solutions, hydrogen, geothermal and geoenergy, energy storage and critical minerals.”

Policy News The European Union has put its stamp of approval on a reworked law yesterday banning all new sales of internal combustion engine (ICE) vehicles from 2035.

“NTPC aims to add 20GW to 30GW nuclear capacity by 2040” “Company will examine deploying small-scale, modular reactors”

[The government of Canada]“recognizes that to meet our ambitious climate and economic objectives to transition to a net-zero economy, additional mechanisms must be in place to expedite and facilitate strategic critical mineral projects from investment and funding opportunities, through regulatory approvals and development, to production."

“It appears the Biden administration is looking at funding roughly a dozen mineral projects overseas in a bid for more resources used in lower-carbon technologies.”

“The law overhauled subsidies for electric vehicles, creating a series of new requirements for vehicles to qualify for the full $7,500 tax credit. One of those new” rules is that 40% of the value of the minerals in a vehicle's battery must come from the U.S. or a country with a free-trade agreement with the U.S. That percentage rises over time, hitting 80% after 2026. "I think that the situation of the last year with the supply of fossil fuels just showed us how dangerous and expensive the dependency on one supplier is." Mr. Seféovic said.

“MSP partners – including Australia, Canada, Finland, France, Germany, Japan, the Republic of Korea, Sweden, the United Kingdom, the United States, and the European Commission – are committed to building robust, responsible critical mineral supply chains to support economic prosperity and climate objectives.”

Deglobalization News

“The father of Taiwan's chip industry said geopolitics have drastically changed the situation facing semiconductor makers and warned that "globalization and free trade are almost dead," and unlikely to come back.”

“As the U.S. turns to Canada for ‘critical minerals,’ Europe might come to rely on the historic mining hub of Sweden.”

Please reach out with any questions you have. Follow me at twitter.com/jamieholman. James Holman |