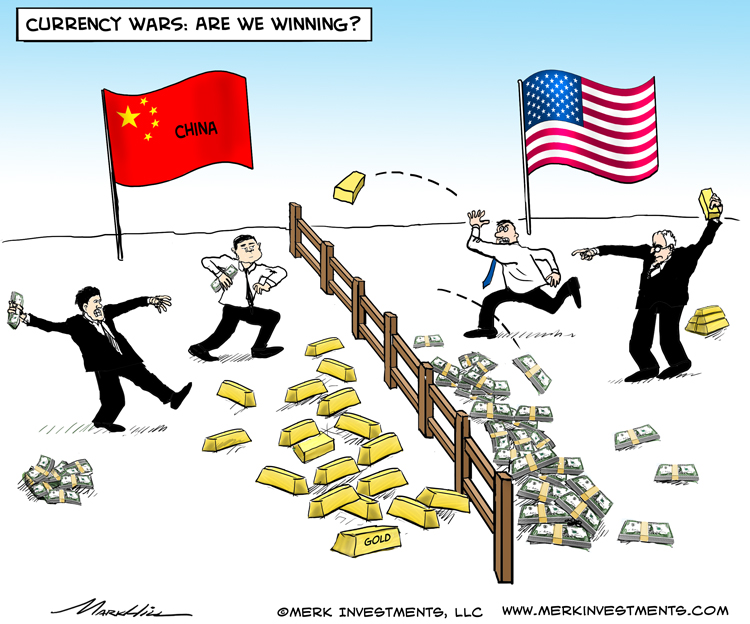

Currency Wars: Winners and Losers

Axel Merk, Merk Investments May 8th, 2013 Who is winning the “currency wars”? Our take on the greenback, yen, sterling, euro and gold:

The U.S. dollar. All the great things a couple trillion dollars in quantitative easing can buy:

Yen. If we think the dollar is the risky proposition, then the Japanese yen may be outright toxic. Did I say that we are short the yen (and generally put our money where our mouth is)? The one thing going for the yen is that neither Prime Minister Abe’s government, nor the Bank of Japan (BoJ) have doubled down in recent days, but that “rally” the yen had, veering away from 100 versus the dollar appears to have already broken down. For those looking for a catalyst, Japan’s upper house elections are coming up in July. While Abe already enjoys a two thirds majority in the lower house, his populist policies might get him a majority in the upper house as well, paving the way for changes to Japan’s constitution. Having said that, such changes may mostly be symbolic, as Japan has long found ways around Japan’s pacifist constitution to ramp up military spending. The only good news for the yen is that the currency’s rapid decline may temporarily halt the deterioration of its current account deficit. The current account matters, as once it is firmly in negative territory, Japan can’t rely on financing its huge debt to GDP ratio domestically anymore. British Pound. The final straw in the glass half empty category may be the British pound. Mark Carney, outgoing head of the Bank of Canada, will lead the Bank of England (BoE) starting this summer. That may be great news for the loonie (Canadian Dollar), but not so much for the sterling. While Carney’s greatest achievement at the Bank of Canada might have been his ability to compete with former Federal Reserve Chairman Greenspan’s obfuscating talk, he has made it clear that he might engage in nominal GDP targeting or introduce a higher inflation target at the BoE. Moving the inflation target may simply be an admission of reality, as the UK has suffered from stagflation for some time. Euro. The European Central Bank (ECB) President appears desperate of late: the euro’s persistent strength may be one of the many reasons holding back growth in the Eurozone. Whereas “everyone” is “printing” money, the ECB has been mopping up liquidity. They can’t help it, as their printing press is more demand driven than the presses of the Fed, BoJ or BoE. As banks in the Eurozone return loans from the ECB, there is little the ECB can do about it. Last week, the ECB cut interest rates. And, sure enough, for about a day, rates fell. But after a few days, short-term German Treasury Bills, as well as longer-term Bonds are roughly about the same. Similarly, spreads in the Eurozone, i.e. interest rate differentials between periphery countries and Germany, are roughly the same. A rate cut was nonsensical as one has to buy two year German Treasuries to get a zero yield; anything shorter and investors pay a negative yield, i.e. pay the German government for the honor of lending them money. There are many problems in the Eurozone, but a low benchmark interest rate isn’t one of them. We continue to believe the euro is cursed to move higher, destined to be the “rock star”, albeit it is likely to continue to be a rocky road. Gold. Is the ultimate currency the ultimate winner in Currency Wars? So as to ensure that no good deed goes unpunished, gold had a rather volatile ride of late. And not surprisingly: as the price of gold moved up 12 years in a row, speculators decided that a good thing is even better when leverage is employed. And, as such, good things come to a screeching halt when margin calls force selling. We now have many investors sitting on paper losses. Some that bought gold because of a meltdown in the Eurozone are selling their positions. On the other hand, not everyone buying gold because of future inflation is on board. Our reason to buy gold has always been motivated by what we believe is too much debt in the developed world. While Eurozone members are trying to address their debt loads through austerity – with rather mixed results – we believe the U.S., U.K. and Japan are more likely to resort to their respective printing presses. In that environment, we believe gold should perform rather well over the coming years. So why not hold only gold? Any investment depends on that investor’s perspective on opportunities, but most notably also on risk tolerance. Just as investing in a single stock, investing in a single currency or in gold alone can be quite volatile. What we like about investing in currencies is that currency wars can be tackled at the core, without taking on equity risk and while trying to mitigate interest and credit risk. We may or may not like our policy makers’ decisions, but more importantly, those decisions may be rather predictable. As asset prices appear to be chasing the next perceived move of policy makers, the currency market may be the right place to express such views. Gold can play an important part in such a strategy, but as the recent past has shown, one needs to have a good stomach to get through the patches when there is substantial volatility when gold is measured in U.S. dollar terms. Please make sure you sign up for our newsletter to be the first to learn as we discuss global dynamics affecting the dollar. Please also register to join our Webinar; our next Webinar is on Thursday, May 23, expanding on the discussion herein. Axel Merk

|