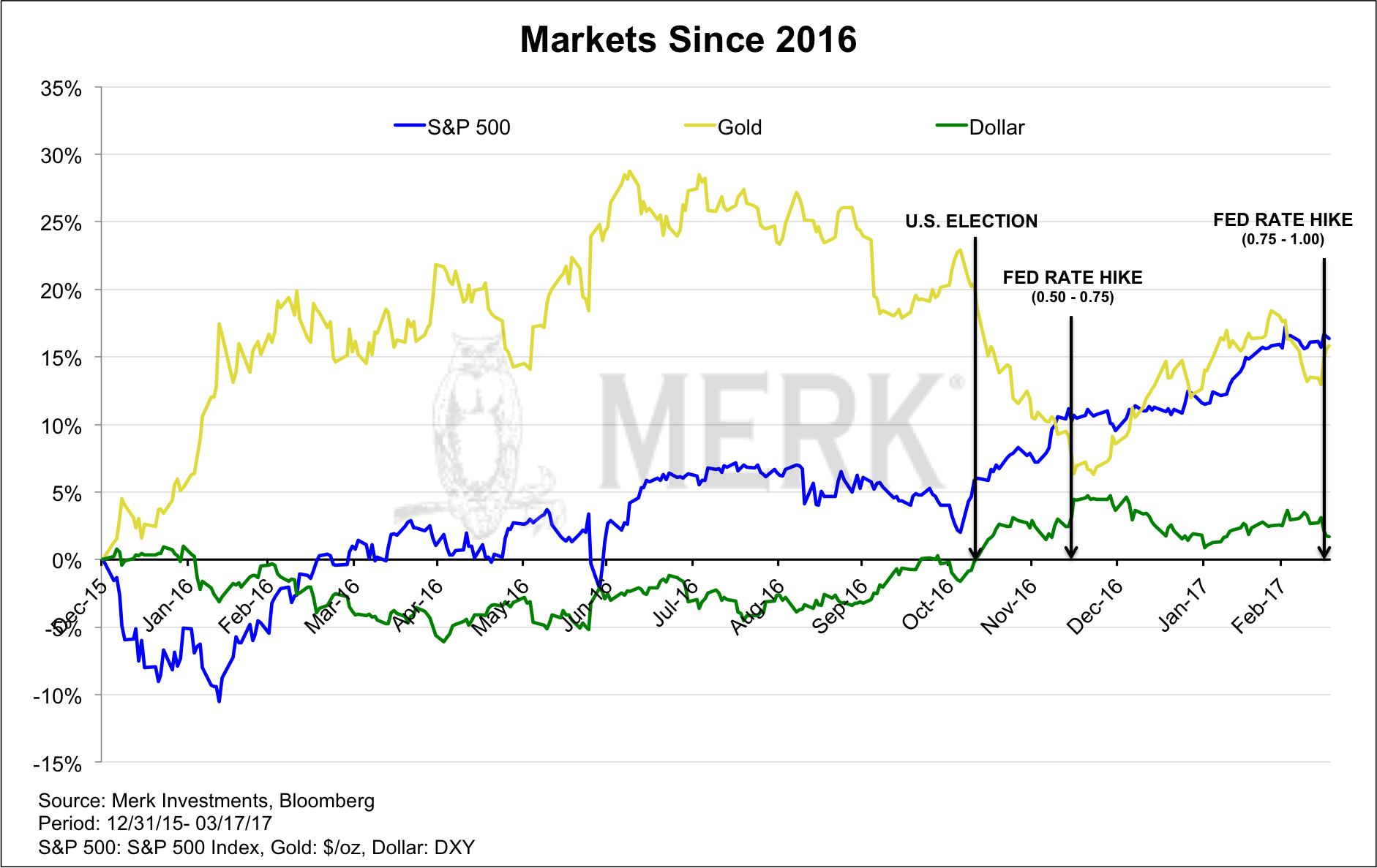

What’s next for the Dollar, Gold & Stocks? Axel Merk, Merk Investments March 22, 2017 Two rate hikes since last year have weakened the dollar. Why is that, and what’s ahead for dollar, currencies & gold? And while we are at it, we’ll chime in on what may be in store for the stock market... Stocks... Where do stocks go from here? Of late, we have heard outspoken money manager Jeff Gundlach suggests that bear markets only happen if the economy turns down; and that his indicators suggest that there’s no recession in sight. We agree that bear markets are more commonly associated with recessions, but with due respect to Mr. Gundlach, the October 1987 crash is a notable exception. The 1987 crash was an environment that suffered mostly from valuations that had gotten too high; an environment where nothing could possibly go wrong: the concept of “portfolio insurance” was en vogue at the time. Without going into detail of how portfolio insurance worked, let it be said that it relied on market liquidity. The market took a serious nosedive when the linkage between the S&P futures markets and their underlying stocks broke down. I mention these as I see many parallels to 1987, including what I would call an outsized reliance on market liquidity ensuring that this bull market continues its rise without being disrupted by a flash crash or some a type of crash awaiting to get a label. Mind you, it’s extraordinarily difficult to get the timing right on a crash; that doesn’t mean one shouldn’t prepare for the risk. Bonds... Gold... After the election, we believe the price of gold came down as the market priced in higher real interest rates in anticipation of lower regulations. We indicated that this euphoria will cede to realism, meaning that regulations might not be cut quite as much. We also suggested that any fiscal stimulus on the backdrop of low employment may be inflationary. That is, expectations of higher real rates might be replaced with expectations of higher nominal rates; net, bonds might not change all that much, but the price of gold may well rise in that environment. Add the Fed to the picture, having raised rates twice now since the election. We have argued that the Fed is and continues to be 'behind the curve,' i.e. is raising rates more slowly than inflationary pressures are building. We believe the Fed is petrified that they might have to go down back to QE when the next recession comes and, as a result, has been very slow in raising rates. Indeed, we believe the Fed will only raise rates if the market delivers a rate hike on a silver platter, i.e. the markets are “behaving” (no taper tantrum). As such, let me make this prediction: if the S&P 500 is up 20% from current levels this October, odds are we will get more rate hikes than are currently priced in; conversely, if the S&P 500 is down 20% from current levels this October, odds are we will get fewer rate hikes than are currently priced in. If you are rolling your eyes that this isn’t too ingenious, I would like to remind readers that this isn’t supposed to be the yard stick the Fed should be using. We believe the Fed is a hostage of the market. Paraphrasing a former Fed official who shall remain unnamed, he indicated to me that the Fed wouldn’t care how the S&P reacts to an FOMC decision, unless, they created a bubble. The Dollar... Aside from real interest rates, when it comes to the dollar, it is worth paying attention to trade policy. So-called experts had predicted a 20% surge in the dollar based on the “border adjustment tax” in the GOP House tax plan. Except that surge hasn’t happened. Maybe the plan is dead. Maybe the plan’s market impact will be different. Our take is: if you introduce barriers to trade, we believe currencies of countries with current account deficits tend to suffer. The greenback qualifies, and the recent decline coincides with more protectionist talk coming from the Trump administration. The Sterling... What gets us really negative about the sterling, though, is their fiscal situation. Sure, there may well be a short squeeze at some point because others don’t like the currency but medium to long-term, we believe the Brits may well go down what we call the “Italian road.” That is, we believe they’ll finance substantial deficits with monetary policy that’s too loose, leading to a currency that will cascade lower over time. That’s because we don’t see how the Brits can finance their budgets. When the Brits had their austerity budgets, their finances had moved from what we would call horrible to bad. Now they may well drift back to horrible as government spending increases to cushion the blow from Brexit. The Euro... Recently, European Central Bank (ECB) head Draghi gave an upbeat presentation at a press conference, suggesting (and I’m putting words into his mouth here) we shouldn’t be overly worried about the various upcoming risk events (Dutch election at the time; the French election, etc.), as there isn’t much as we can do about them anyway; and if something bad were to happen, well, he’ll do whatever it takes. Then the Dutch rejected populism. Then the rumor came up that the ECB may hike rates before ending the purchases of securities; this rumor was given credence as the Austrian ECB member of the governing counsel suggested that there are many different rates and, yes, some could be raised before the bond purchases are done. Separately, we believe the euro has increasingly become a so-called funding currency. Amongst others because rates are so low, speculators are borrowing in euros to buy higher yielding assets. If we have a risk off event, e.g. a sharper decline in stocks, those speculators might have to reduce their bets and, as part of that, buy back the euro. Short covering may not lead to sustainable rallies in the euro, but it’s a piece of the puzzle worth watching. EM currencies... Make your portfolio great again... As you might have gathered, I believe most investors are over-exposed to US equities. Equities have performed so well that it’s difficult to get anyone to listen to this concern. And that’s exactly the type of environment that is a fertile ground for bubbles. Next time, we will be giving specific portfolio construction ideas for this environment. To be alerted, please make sure you subscribe to our free Merk Insights, if you haven’t already done so, and follow me at twitter.com/AxelMerk. If you believe this analysis might be of value to your friends, please share it with them. Axel Merk U.S. Dollar (DXY) Index: DXY is a measure of the value of the United States dollar relative to a static basket of currencies with Euro (EUR) 57.6% weight, Japanese yen (JPY) 13.6%, Pound Sterling (GBP) 11.9%, Canadian dollar (CAD) 9.1%, Swiss franc (CHF) 3.6% and Swedish krona (SEK) 4.2% weight. The DXY is a generally well-known measure of the value of the US dollar versus major foreign currencies, and as such makes a relevant reference point for directional currency strategies. |