Helping our clients achieve superior risk-adjusted portfolio performance

is Merk's mission

Through a robust investment process, we aim to deliver truly uncorrelated returns that seek optimal profit potential within tailored investment objectives.

Investment Strategies

The strategies Merk offers include gold and gold mining.

Insights & Reports

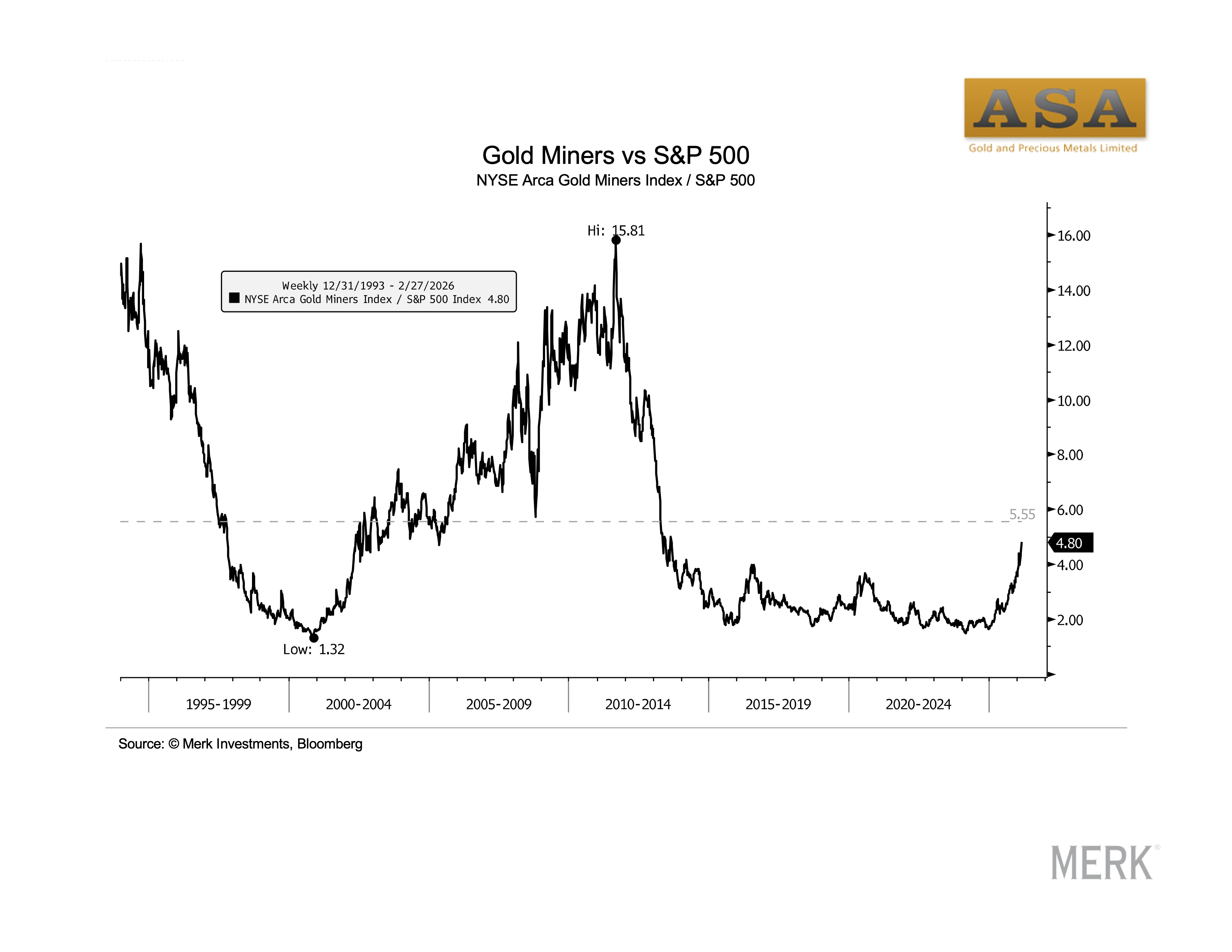

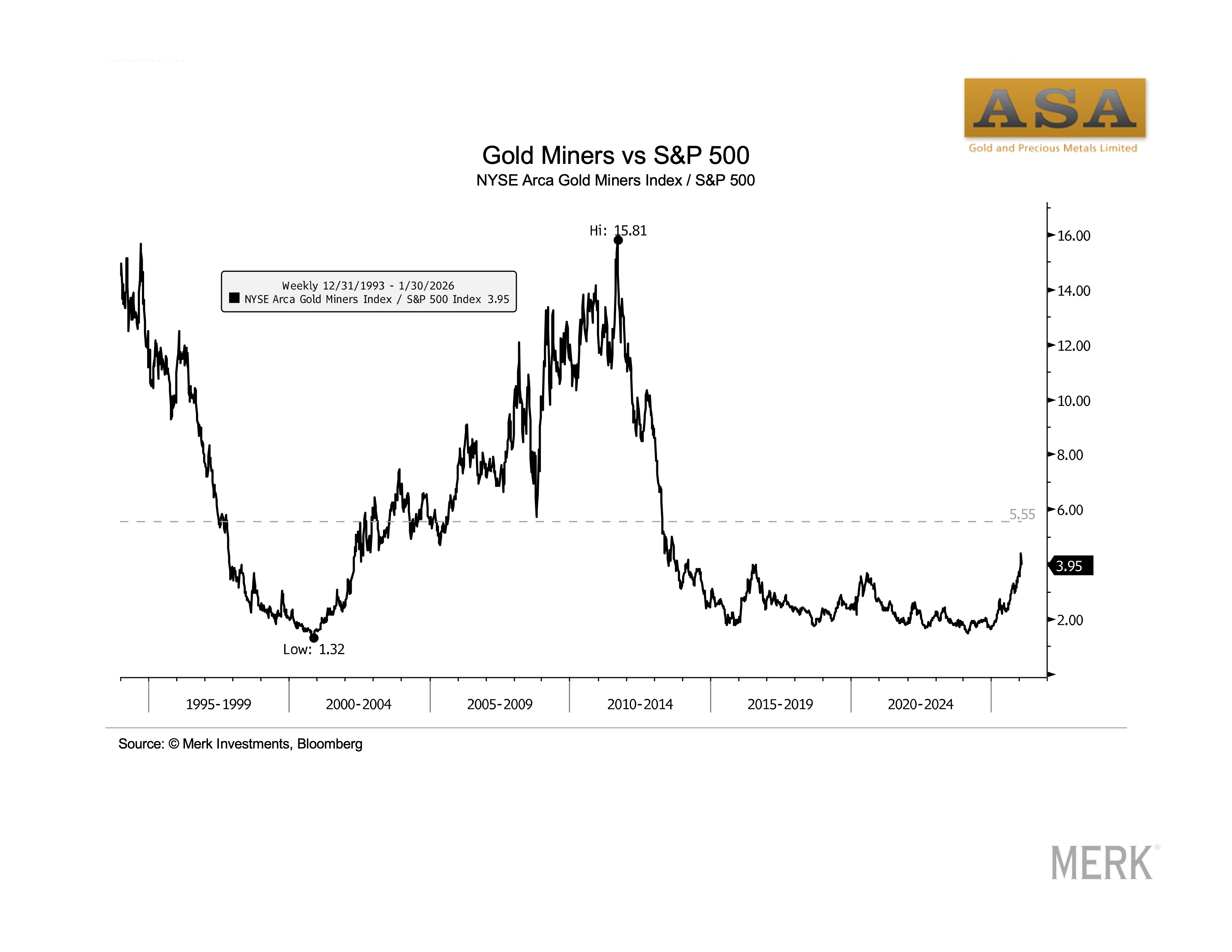

Gold Miners: Bargains or Peaking Out?

CIO Axel Merk with Portfolio Managers Peter Maletis & Jamie Holman

Replay Now Available

Webinar held Nov 13, 2025

Tweets

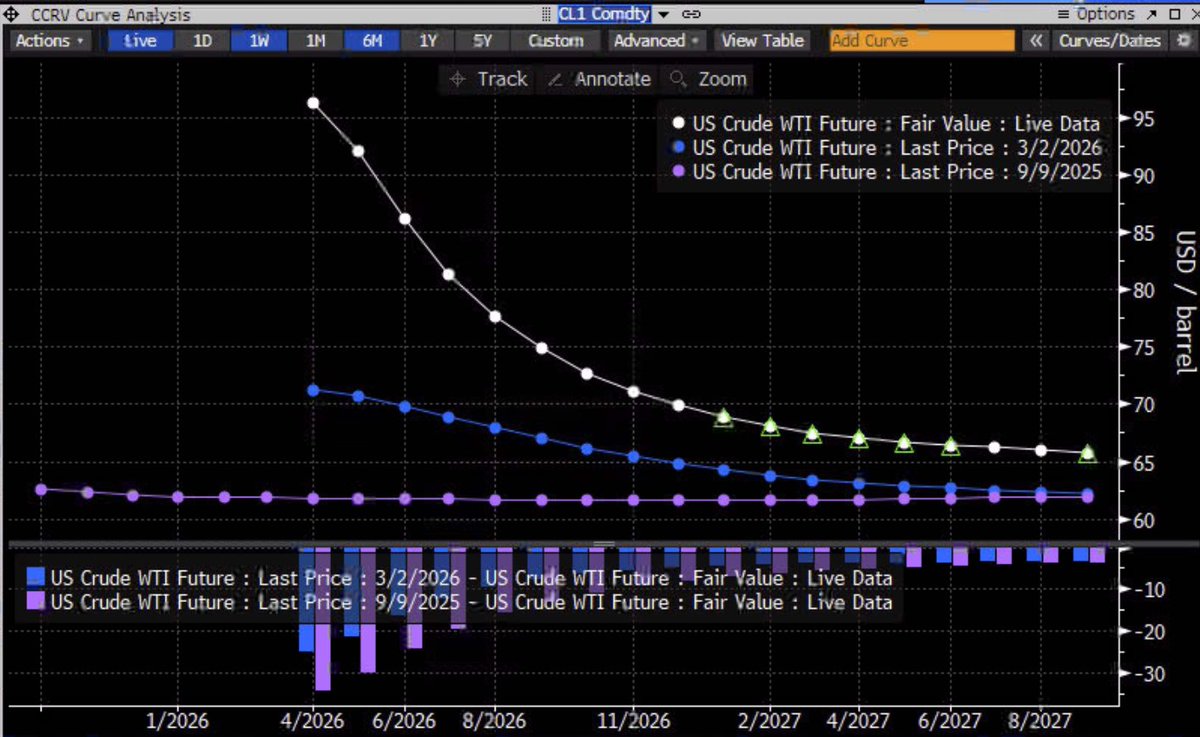

Oil price futures, 2 years out:

White: current

blue: a week ago

purple: 6 months ago

Source: Bloomberg.

Happy 100th Birthday Alan Greenspan!

The weaker than expected jobs report shouldn't be that surprising: faced with tremendous policy uncertainty, businesses control what they can: expenses/labor.

The upside is a "productivity boom" - doing more with less.

My Q: is that boom driven by AI or uncertainty?

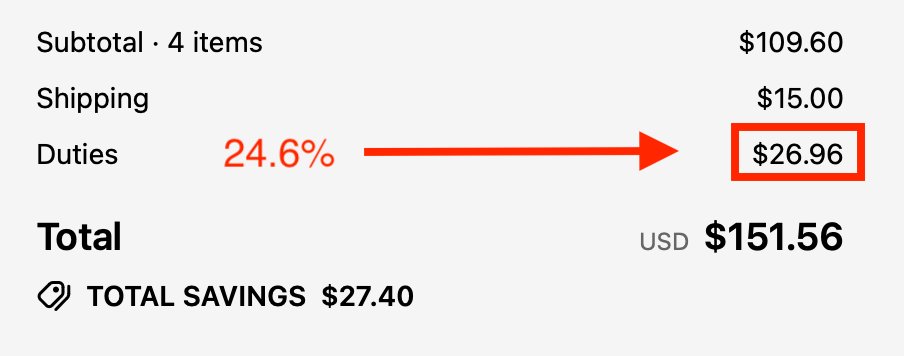

Tariffs are real...

I ordered socks from the UK (don't ask!) -- I order them in bulk every few years when they are on sale. 24.6% tariff surcharge -- I hope Uncle Sam will put the money to good use.

FWIW/IMHO: markets are pricing in a supply shock. Different from the pandemic, no expectation of rate cuts that wouldn't help. Real rates up.

What a journey. Our assets under management just crossed $5B. Thank you to our investors!

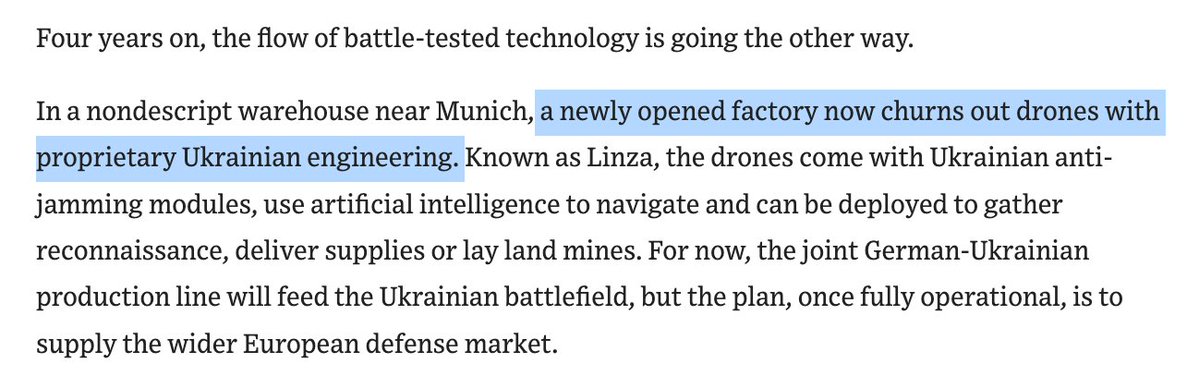

Where do Europeans get the latest technology for the modern battlefied?

Ukraine.

wsj.com/world/europe/u…

Become a Part of the Merk Community

Subscribe to our regular reports and research, as well as all updates relating to MERK

We adhere to a strict Privacy Policy governing the handling of your information. Opt-out any time.

thoroughly researched perspectives on the trends shaping global markets.

topics may span disruptive tech, income strategies & emerging economies.

27.6k subscribers