Endeavoring to Generate Value in Gold Mining

May 21, 2024

Insights

Axel Merk

Axel Merk

Since ancient times, long before Mark Twain coined the term “There's gold in them thar hills!” prospectors have been seeking gold. Gold mining is both alluring and challenging. The allure is obvious: to strike gold! Challenges are multifold as any gold mining investor has experienced. Below, I discuss how we endeavor to generate value in gold mining through ASA Gold & Precious Metals Ltd.

(NYSE:ASA), the closed-end fund we manage.

Investing in gold miners is a levered play on gold, the saying goes. That is, should the price of gold rise 33.33% from $1,500 an ounce to $2,000 an ounce, and the cost of mining is $1,000 an ounce, that rise translates to a 100% gain to the bottom line. Except, the real world looks very different. Amongst others, when the price of gold moves higher, it has at times been associated with higher energy prices – a crucial cost component in mining. And when things go well for miners, other stakeholders, notably workers (higher wages) and governments (higher taxes) might want a share of the action. In addition, mine life is limited; at least part of the cash flow tends to be re-invested in further developing the mine, or to acquire other mines. Add to that a myriad of other risks, not least of which is management risk.

When you move to the junior segment of the mining sector (development and exploration companies) it’s almost like buying an option on finding gold. These are, for the most part, equity investments, but they somewhat trade as if they were options. Management that can execute, is able to raise money for further stages of development to get a project into production. When the Federal Reserve made “higher for longer” front and center in its communication strategy, junior mining companies became subject to credit risk, in the sense that financing to develop the next stage of their development may be more difficult to obtain when credit conditions are tight. We put the end on “higher for longer” last October when Fed Chair Powell gave what I call a “mission accomplished” speech. By all means, interest rates have not been cut and inflation has been more persistent than what the Fed would have liked. But what has changed is the Fed’s bias? That, in our assessment, makes all the difference.

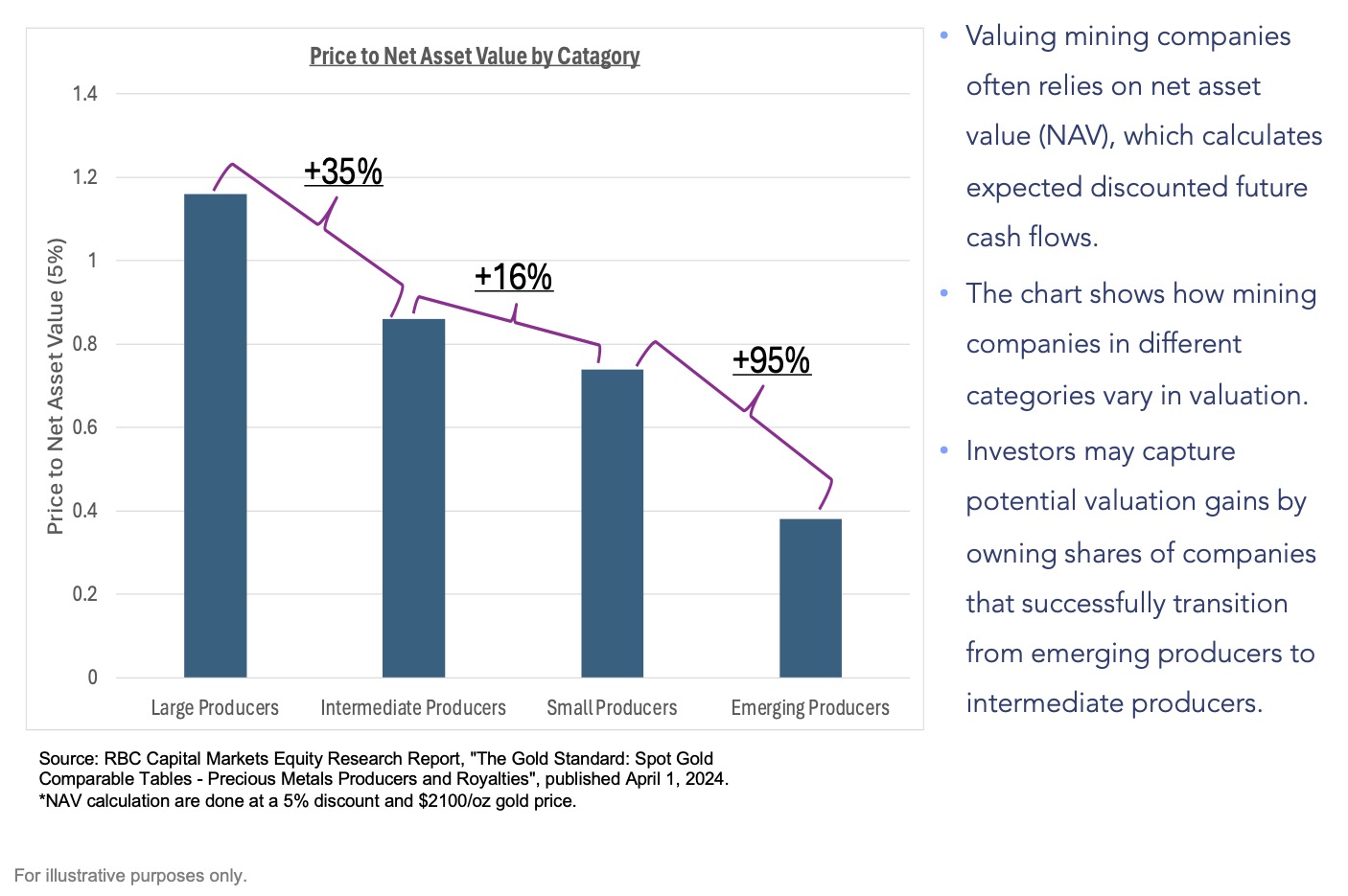

So how does one invest in this space? On the one hand, it can offer the potential for lucrative returns, but, on the other hand, it can have plenty of pitfalls. At Merk, as elaborated on in a recent webinar, we believe mining is very much suited for active management. One of the key reasons is that investing via an index-based approach precludes investing early in the life of a company where substantial value can be created. Active management, in contrast, can seek to capture the value accretion when a mining company advances to the next phase in its life cycle.

In the mining space, our investment style for ASA is akin to venture capital and private equity in other sectors. We seek out what we believe to be world-class management teams and world-class assets. For ASA, we achieve this through early-stage investments in teams we consider to be exceptional and in companies developing what we believe are tremendous assets. Actively participating in early funding rounds allows us to establish larger stakes in these companies. While we historically don’t take an activist approach, our input can help shape the company's strategy, potentially strengthen management, and enhance the overall quality of the company, making it more attractive to larger institutional investors in the future.

These deals often have compelling structures where the fund can gain upside through warrants. Warrants are a win-win for investors and companies. For the investor, additional shares can be purchased at an agreed-on price before expiration, leading to additional gains should the warrants be in the money. For the company, it is a win because exercising a warrant means additional cash goes to the company in return for shares.

We witness value creation when junior companies are added to indices, attracting passive capital, and then see further value accretion as these companies move up to larger indices. For example, Australian-listed Emerald Resources was added to the ASX 200 in late 2023; the company was also added to the two largest precious metal ETFs, GDX and GDXJ, in late 2023 and early 2024. From April 2023 to April 2024, Emerald significantly outperformed GDXJ. Below is the comparative return of Emerald Resources (in U.S. Dollar) versus GDXJ during the period for the period (source is Bloomberg):

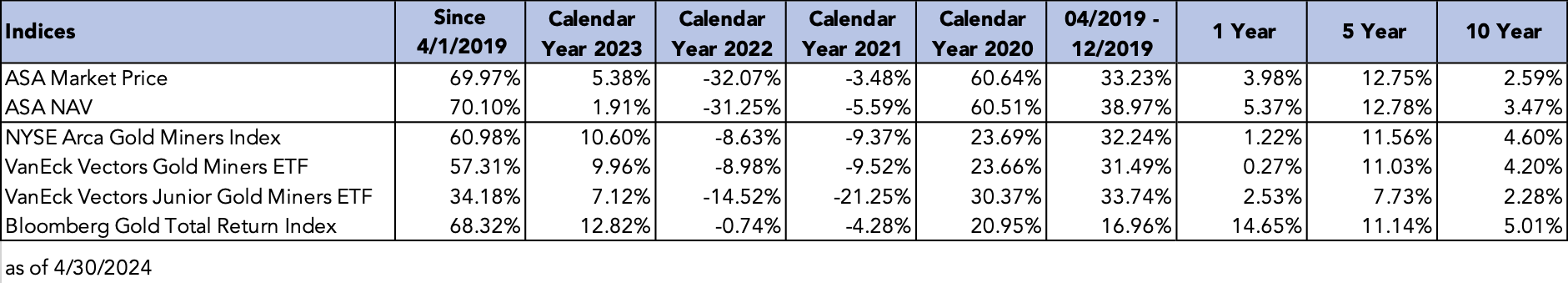

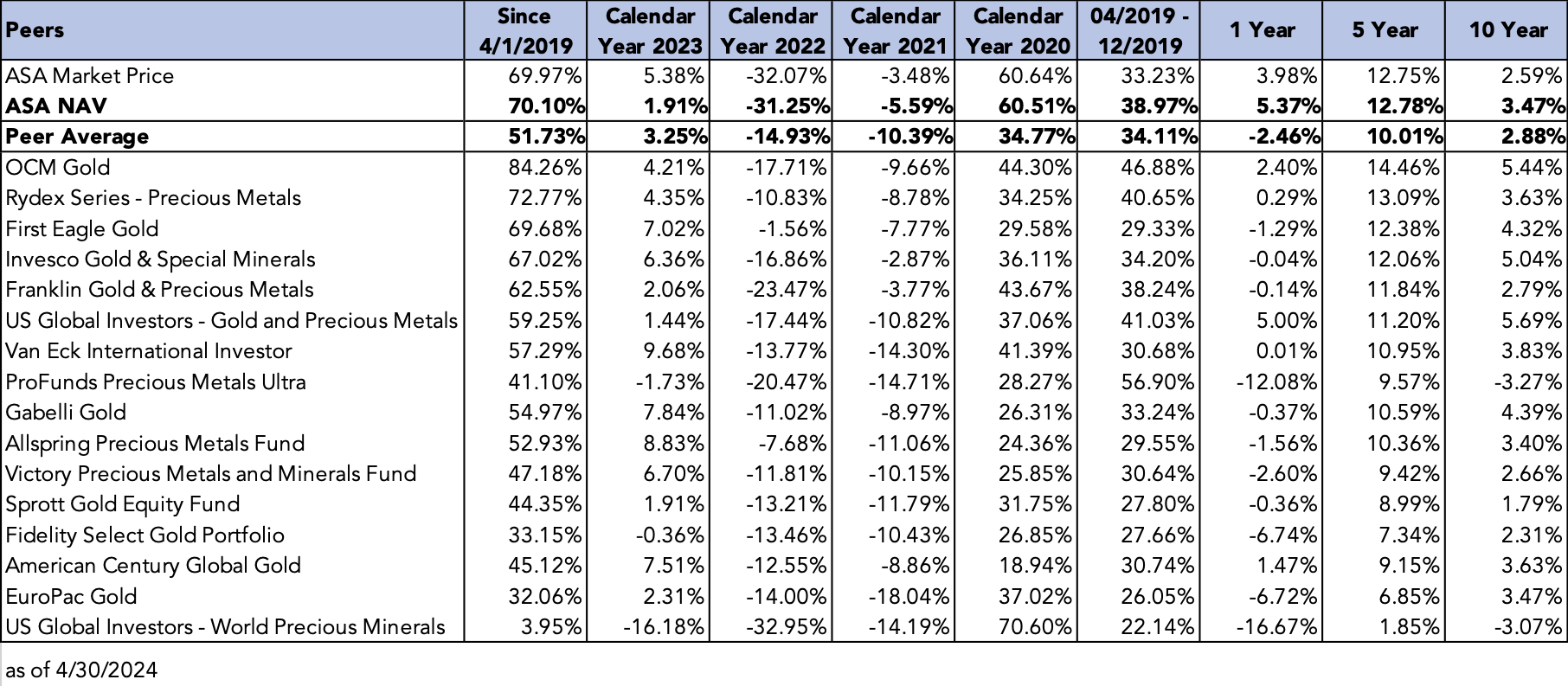

The returns generated by such a portfolio can be astounding. That said, of course there are risks associated with the strategy and in the “higher for longer” environment, the strategy lagged. Below is ASA’s performance since April 2019 when Peter Maletis started managing the portfolio:[1]

ASA’s mandate is to “seek long-term capital appreciation primarily through investing in companies engaged in the exploration for, development of projects or mining of precious metals and minerals.” We have chosen to focus on the junior segment for a few reasons, most notably because the closed-end fund structure is ideally suited to take advantage of it. As a closed-end fund, our capital can be patient as there are no daily flows. Notably, because ASA is more expensive to run than an ETF or mutual fund, hugging an index or merely replicating what could be done in an open-end fund might not provide the value to investors they deserve. Importantly, ASA provides investors with access to what we believe are the best up-and-coming precious metal teams and assets, an opportunity most would otherwise unlikely have. This is because ASA management, with a combined decades of industry experience, has deep ties and access to deal flow from both public and private companies that is not available to all investors, as well as the expertise and connections to subject matter experts to appropriately vet these investments.

We endeavor to give investors exposure to the precious metals asset class while aiming to drive high rates of return even in a flat commodity price environment. We seek investments that "stand on their own two feet" and can be further enhanced by rising precious metal prices.

In our assessment, gold and gold mining tend to perform well when other investments do poorly. Although this is a generalization, as there is neither a perfect correlation nor any assurance it will hold true in the next S&P bear market, investors may choose to invest in ASA for the significant diversification benefits they can add to their portfolios with a small allocation.

The counter-cyclical and volatile nature also means that gold mining funds are often a mismatch in asset management firms. However, an advantage we have at Merk is that these days, we currently manage $1.3 billion in gold and gold mining, meaning we fully embrace the unique characteristics of the sector. One thing we have learned – as any gold mining investor is aware – is that one needs to combine a long-term process seeking to maximize returns with the risk that there will be a cyclical downturn. The good news is that the “higher for longer” environment is behind us, and we are enthusiastic about the potential for the holdings we have in the portfolio.

I have personally expressed this by significantly increasing my personal ownership of ASA.[2] Mind you, as a closed-end fund, ASA is not offering any shares to the public. Instead, shares are trading based on supply and demand. ASA has provided investors with an opportunity to invest in, and provide capital to, the precious metals sector since 1958.

To stay informed, subscribe to our newsletter at merkinvestments.com/newsletter and to follow me at twitter.com/AxelMerk. Please reach out with any questions you have.

Axel Merk

President and CIO, Merk Investments

[1] Peter Maletis started managing ASA on April 1, 2019. On April 12, 2019, ASA shareholders approved Merk Investments as ASA’s investment manager. On April 1, 2022, Jamie Holman joined the ASA portfolio management team at Merk Investments. Note that the 10-year performance shown includes a little more than 5 years performance Merk Investments is not associated with.

[2] I currently own 124,644 shares; some of these shares are owned by my wife, but I am deemed a beneficial owner for public disclosure purposes.

Certain Tax Information: ASA is a "passive foreign investment company" for United States federal income tax purposes. As a result, United States shareholders holding shares in taxable accounts are encouraged to consult their tax advisors regarding the tax consequences of their investment in the Company's common shares.

This report was prepared by Merk Investments LLC (“Merk Investments”),and reflects the current opinion of the authors. It is based upon sources and data believed to be accurate and reliable. Merk Investments makes no representation regarding the advisability of investing in the products herein. The information contained herein reflects Merk Investments’ current views and opinions with respect to, among other things, future events and financial performance. Charts, graphs, and tables are provided for illustrative purposes only. Any forward-looking statements contained herein are based on current estimates and expectations. Opinions and forward-looking statements expressed are subject to change without notice. This information does not constitute investment advice and is not intended as an endorsement of any specific investment. The information contained herein is general in nature and is provided solely for educational and informational purposes. Some believe predicting recessions is either impossible or very difficult. The information provided does not constitute legal, financial or tax advice. You should obtain advice specific to your circumstances from your own legal, financial and tax advisors. Past performance is no guarantee of future results.

Become a Part of the Merk Community

Subscribe to our regular reports and research, as well as all updates relating to MERK

We adhere to a strict Privacy Policy governing the handling of your information. Opt-out any time.

thoroughly researched perspectives on the trends shaping global markets.

topics may span disruptive tech, income strategies & emerging economies.

27.6k subscribers