Strategic Minerals: Global Energy Revolution

Jul 18, 2023

Insights

James Holman

James Holman

As countries shift from fossil fuels to clean energy, power dynamics, resource allocation, and industries are undergoing massive changes, particularly in the mineral and battery sectors. International alliances, investments, policy changes, and strategies are facilitating this global shift. This overview encompasses key developments from the US's mineral source diversification, Europe's green economy goals, and Asia's clean energy policies, including new partnerships in the electric vehicle industry. Explore insights from the field's major stakeholders and trendsetters.

Please note that the articles listed below are the opinions of the authors and are provided for information purposes and do not necessarily reflect my opinions nor the opinions of Merk Investments; emphasis may have been added in quoted text.

US-led minerals partnership shortlists projects for green energy shift (FT)

The US-led Mineral Security Partnership, including 12 nations and the EU, is selecting significant critical-minerals projects to counter China's dominance in materials vital for green technologies. From 200 options, about 15 diverse projects spanning mining, processing, and recycling in Africa, Europe, Latin America, and Asia have been identified. This move is prompted by China's control of the critical mineral supply chain, seen as a vulnerability amid rising demand for minerals like lithium. The partnership aims to diversify supply chains, ensuring adherence to elevated environmental, social, and governance standards while addressing issues like child labor and environmental harm. Deep-sea mining is excluded due to an insufficient understanding of its impact.

Materials for Energy Storage and Conversion A European Call for Action (ERMA)

Are you curious about the future of energy storage and conversion? Well, the ERMA Investment Pipeline is a treasure trove of information! As of May 2023, over 50 investment cases have been identified, with a total investment need exceeding EUR 15 billion. These projects could significantly increase the amount of materials sourced from the EU by 2030, which is great news for the shift towards a circular green economy. The figure below shows the geographic distribution of current and potential raw materials projects identified through the ERMA investment pipeline. So, if you want to stay ahead of the game in the world of energy storage and conversion, keep an eye on the ERMA Investment Pipeline!

Image Source: ERMA (2023). Retrieved from https://erma.eu/app/uploads/2023/06/8bafd7ec.pdf

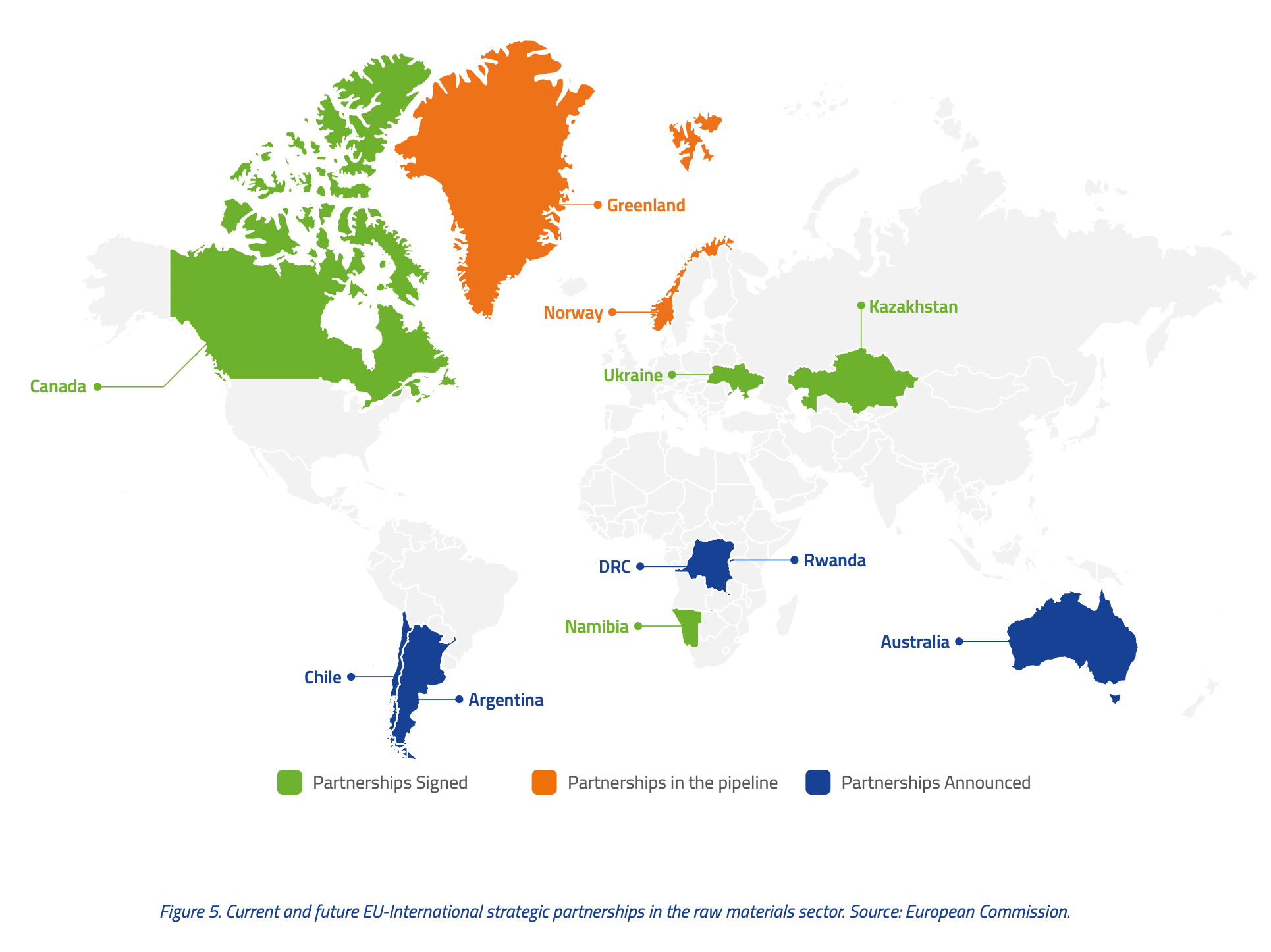

Raw materials have recently gained substantial attention due to potential supply chain disruptions, which underpin EU's economic prosperity, social stability, and safety. While the EU boasts significant capacity, developing international partnerships for supply diversification and bridging material gaps is crucial. The European Raw Materials Alliance (ERMA) is ramping up strategic partnerships globally, including key alliances with Canada and Ukraine, and potential ones with countries like Greenland, Norway, Argentina, Australia, Chile, DRC, and Rwanda. ERMA assists the European Commission not only in fostering individual investment cases but also in identifying emerging technologies and research topics. This encompasses sectors like solar and wind energy, hydrogen-related technologies, and the exploration, mining, processing, and recycling of materials.

Image Source: ERMA (2023). Retrieved from https://erma.eu/app/uploads/2023/06/8bafd7ec.pdf

Asia Leads Clean Energy Transformation: A Global Policy Update (BNEF)

Asia is spearheading clean energy policy changes this month, with China enhancing support for pumped hydro, solar thermal, and rural electric vehicles. In contrast, India has slashed its EV subsidies, but remains optimistic about renewable power generation. Vietnam is wagering on wind power, while Japan revises its hydrogen strategy and considers the region’s first target for low-carbon jet fuel. The EU sets a global precedent by passing the world’s first carbon import tariff. Meanwhile, the G7 nations reaffirmed their support for LNG in their 2023 summit. In the US, bureaucratic hurdles could potentially slow the uptake of new domestic content bonuses under the Inflation Reduction Act. High costs might shrink the subsidy benefit for solar projects. However, a forthcoming proposal on power emissions signals a favorable outlook for carbon capture. Despite improvements in the latest Zero-Carbon Policy Scoreboard by BloombergNEF, largely thanks to the IRA, the US trails behind EU nations.

Tesla's Charging Empire: GM and Ford Forge Bold Alliance for Electric Future (AP)

In a significant move, General Motors (GM) and Ford are set to adopt Tesla’s charging network and connector for their electric vehicles (EVs), commencing in 2025. This bold decision could see Tesla's connector become the industry standard. GM’s CEO, Mary Barra, and her Tesla counterpart, Elon Musk, publicly announced the move in a recent online conversation. The partnership offers GM and Ford EV owners improved access to charging, nearly doubling the number of available charging stations. Tesla's supercharger network, a considerable competitive advantage, is widely seen as more reliable and strategically located. Mike Austin, an analyst for Guidehouse Insights, suggested that if other large EV manufacturers follow suit, Tesla could see a significant revenue increase. Financial details of the agreement remain undisclosed.

New York Propels Clean Energy Transition: State Utility Mandated to Ditch Fossil Fuels by 2030 (Semafor)

New York state has passed a law forcing its state-run electric utility to cease using fossil fuels by 2030. This bold move, fueled by changes in the U.S. Inflation Reduction Act, requires the country's largest public utility to push for renewable energy sources, especially if private utilities lag in reaching the state's 70% renewable electricity goal by decade's end. This signals a shift in the balance of power between public utilities serving 14% of Americans and their privately-owned counterparts, with public utilities now incentivized to take the lead in decarbonizing the power sector. On the horizon, states like Maine and Michigan are considering replacing private utilities with public or nonprofit versions, promoting renewable energy.

Saudi Arabia's Mining Sector Growth: The Quest for Skill Development (Mining Journal)

According to Morgan Bazilian, professor and director of the Payne Institute at the Colorado School of Mines, Saudi Arabia's biggest challenge in developing its mining sector will be cultivating and drawing in the necessary mining skills. In a conversation with Chris Cann, managing editor of Mining Journal, Bazilian suggested that Saudi Arabia could take cues from regions like North America and Australia, where mining skills have been effectively developed. Given Saudi Arabia's substantial investment capacity, it could quickly implement these strategies.

Reviving Henry Ford's Vision: CEO Jim Farley Charts Path for Vertical Integration and EV Dominance (BNEF)

On Ford's investor day, CEO Jim Farley mapped out a plan of vertical integration to echo Henry Ford's model of self-sufficiency. In his nutshell: savings, in-house production, and fresh competition for Tesla. Farley aims to slash $2.5 billion in costs this year through efficient industrial practices and supply chain optimization. And the race for the electric vehicle market? Ford is set on achieving an 8% profit margin by 2026, keeping up with Tesla and others by offering a gamut of electric models, like the Mustang Mach-E. Their secret weapon? Cutting vehicle costs, exemplified by the Mustang Mach-E's $5000 reduction this year. With licensing CATL technology for in-house battery production and forging new lithium partnerships, Ford is revving up for the future of electric mobility.

Enduring Power: Tesla's Batteries Exhibit Less Than 2% Degradation Per Year, Study Reveals (Inside EVs)

According to a recent study, Tesla's battery capacity degradation is less than 2% per year on average. This means that after eight years, the battery will still have over 80% of its original capacity. The study analysed data from over 1,000 Tesla vehicles in the US and Europe and found that the Model S and Model X had slightly higher degradation rates than the Model 3 and Model Y. Nevertheless, Tesla's batteries are still performing well compared to other electric vehicles on the market.

Strategizing Amid Uncertainty: Toyota Tsusho's Plan to Counter Potential Lithium Nationalization (Times of India)

Toyota Tsusho, the Japanese trading giant, is on high alert after Chile's move to nationalize its lithium industry, fearing that other countries might follow suit. CFO Hideyuki Iwamoto voiced concerns over growing nationalism leading to export restrictions on raw materials like lithium, essential for electric vehicle batteries. However, they've got a plan! By processing raw minerals locally before exporting, they aim to dodge potential risks. Despite high inflation and fluctuating lithium prices, they remain optimistic about their joint venture with Orocobre in Argentina and expect a slight surge in lithium prices in the long term.

ProLogium Chooses France for Gigafactory Location Amid Fierce European Competition (Reuters)

Taiwanese company ProLogium has chosen France over Germany and the Netherlands for its first overseas car battery plant, thanks to aggressive lobbying from President Emmanuel Macron, attractive deal incentives, and competitive power prices. The gigafactory, set to begin production in 2026, will be located in the northern port city of Dunkirk and will be the fourth of its kind in the region, central to Europe's burgeoning electric car industry. Amid increasing dependence on Asian-made batteries for electric cars, European leaders are pushing to foster domestic industry growth. This move became even more urgent after the United States passed the Inflation Reduction Act, which includes massive tax subsidies for carbon emissions reduction and domestic production boosting. Besides, the ProLogium plant is expected to create about 3,000 jobs directly and potentially up to four times as many indirectly, bolstering a region that has experienced industrial decline over the years. Macron is eager to leverage recently relaxed EU state aid rules to offer new tax breaks and subsidies to encourage investment in green technologies.

Macron Sparks Green Revolution: New Incentives to Ignite €20B Investment and Boost European-Made EVs (Reuters)

President Emmanuel Macron announced on Thursday that the French government would introduce this incentive in next year's budget. The goal? To spark private investments worth 20 billion euros by 2030, leading to a wave of job creation.

But wait,

there's more. Macron is shifting gears in the electric car market too. Now, the

existing cash incentive of up to 5,000 euros for new electric car buyers comes

with a catch - the cars must be made in Europe, meeting rigorous low-carbon

standards. It's a tough road ahead for non-European carmakers, as this

condition effectively revs up the competition. Green is the new black in

France, it seems!

Strategic Alliances in Lithium Market: Livent Partners with GM to Secure Future and Meet Soaring Demand (Benchmark)

Livent, a seasoned lithium hydroxide supplier, has snagged major deals with Tesla, GM, BMW, and others, thanks to its expertise in crafting battery-grade products. However, it needed more muscle to satisfy growing customer demands and the Inflation Reduction Act. To solve this, Livent inked a partnership with GM, providing assurance for their delivery on new growth projects. This partnership isn't just strategic, it's also a survival tactic. With Livent and Allkem's market capitalization around $5 billion each, this alliance guards against potential acquisition, securing their future in the high-stakes lithium supply chain.

U.S. Forest Service Greenlights Land Swap: Rio Tinto's Controversial Arizona Mine Inches Forward (Reuters)

In an unfolding controversy, the U.S. Forest Service plans to re-publish an environmental report by July, initiating a land swap between the U.S. government and mining giant Rio Tinto. The proposed swap would enable the contentious Resolution Copper project in Arizona. This development is a significant blow to Native Americans, notably the Apache tribe, who staunchly oppose the mine project that threatens a religiously important site, yet promises to meet over a quarter of U.S. copper demand vital for the green energy transition. The case revolves around a land swap approved by Congress in 2014, which the Trump administration executed and Biden's administration subsequently withdrew to review Apache's concerns. Notwithstanding, Apache Stronghold, a nonprofit group composed of San Carlos Apache tribe members, have so far been unsuccessful in their legal efforts to halt the federally-owned Oak Flat Campground's transfer. The U.S. Forest Service insists that an 1852 treaty does not provide the Apaches with land rights. Wendsler Nosie, who leads the Apache Stronghold, expressed disappointment but remains committed to the cause. Rio Tinto affirmed its respect for the legal process and the intent to smelt copper domestically.

Gas-Friendly G-7 Gets Quixotic on Climate and Clean Power (BNEF)

The Group-of-Seven (G-7) nations' recent summit in Hiroshima, Japan, underscored the difficulty in compelling large developing nations to speed up their decarbonization efforts without considerable financial backing. Despite climate change and energy constituting roughly 25% of the summit's decision text, the communique lacked robust and achievable commitments on clean power. It did, however, spotlight clean technology manufacturing and the continued impact of Russia's Ukraine invasion and the global energy crisis. The communique viewed liquefied natural gas and "publicly supported investment in the gas sector" as appropriate temporary responses. Among the G-7 countries, only two align their 2030 emissions targets with the 1.5C pathway. The G-7 aims to achieve peak global emissions by 2025 and seeks 150GW of offshore wind capacity additions from 2022 to 2030.

Johnson Matthey Says US Subsidies Spur Hydrogen ‘Feeding Frenzy' (BNEF)

The Inflation Reduction Act (IRA) introduced by President Joe Biden is driving a significant boost in the green hydrogen industry, as per Johnson Matthey Plc, the world's leading recycler of platinum group metals. The Act’s subsidies for hydrogen produced from renewable electricity are drawing European firms to invest in the US, given the lack of matching incentives in Europe. CEO Liam Condon anticipates massive growth acceleration beyond 2025-2026. Recent investment instances include Denmark’s Topsoe A/S's $300 million hydrogen electrolyzer factory and Norway’s Nel ASA's factory in Michigan. Johnson Matthey, expanding into hydrogen after closing its battery unit last year, is planning a hydrogen catalyst plant in the US in collaboration with Plug Power. The growth of the green hydrogen industry is vital for reducing emissions in industrial processes, power generation, and shipping.

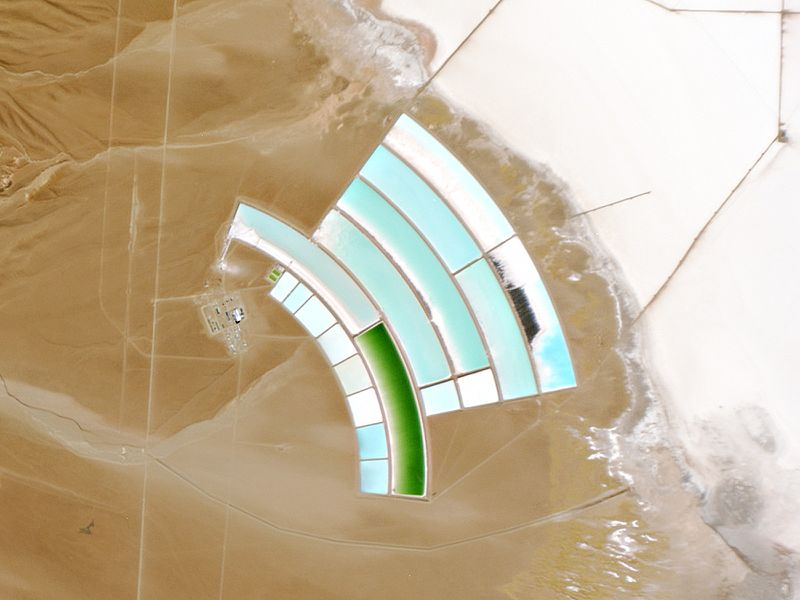

Salt-encrusted lake beds, called salars, are scattered across the high, dry, and windy Puna de Atacama. Formed from the concentrated remnants of vast ancient lakes, the salars hold many soluble minerals, like potassium salts, lithium salts, and table salt. The Salar de Olaroz lithium mine is a facility that is capable of producing 17,500 metric tonnes of lithium carbonate per year

Please reach out with any questions you have. Follow me at twitter.com/jamieholman.

James Holman

Portfolio Manager, Merk Investments

This report was prepared by Merk Investments LLC (“Merk Investments”), and reflects the current opinion of the authors. It is based upon sources and data believed to be accurate and reliable. Merk Investments makes no representation regarding the advisability of investing in the products herein. The information contained herein reflects Merk Investments’ current views and opinions with respect to, among other things, future events and financial performance. Charts, graphs, and tables are provided for illustrative purposes only. Any forward-looking statements contained herein are based on current estimates and expectations. Opinions and forward-looking statements expressed are subject to change without notice. This information does not constitute investment advice and is not intended as an endorsement of any specific investment. The information contained herein is general in nature and is provided solely for educational and informational purposes. The information provided does not constitute legal, financial or tax advice. You should obtain advice specific to your circumstances from your own legal, financial and tax advisors. Past performance is no guarantee of future results.

Become a Part of the Merk Community

Subscribe to our regular reports and research, as well as all updates relating to MERK

We adhere to a strict Privacy Policy governing the handling of your information. Opt-out any time.

thoroughly researched perspectives on the trends shaping global markets.

topics may span disruptive tech, income strategies & emerging economies.

27.6k subscribers