ASA: Precious Metal Miners at a Discount Attracts Saba

Mar 13, 2024

Insights

Axel Merk

Axel Merk

Among precious metals funds, NYSE:ASA, a +$300 million closed-end fund investing in gold and precious metals since 1958, is truly unique. Now activist investor Saba threatens to replace ASA’s board and potentially repurpose the fund. If Saba succeeds in taking control of ASA, I believe it will be detrimental not only for ASA shareholders, but also for the companies ASA invests in and the gold mining sector. ASA’s fate matters regardless of whether you are a shareholder.

Precious metals investments vary

Precious metals investments have different risk profiles depending on whether you invest, say, in physical gold, large producers, royalty companies or exploration and development companies. ASA, unlike a mutual fund or ETF, doesn't accept new money, nor can investors redeem their investment at net asset value. Instead, the shares trade on the NYSE and investors buy and sell the shares on the secondary market. Free from daily in-flows and outflows, ASA can invest for the long term, often in what are illiquid securities. That's precisely what we've done since shareholders approved Merk as the portfolio manager of ASA in April 2019: shifting the fund’s portfolio into small cap mining companies that today comprise over 70% of ASA's assets.

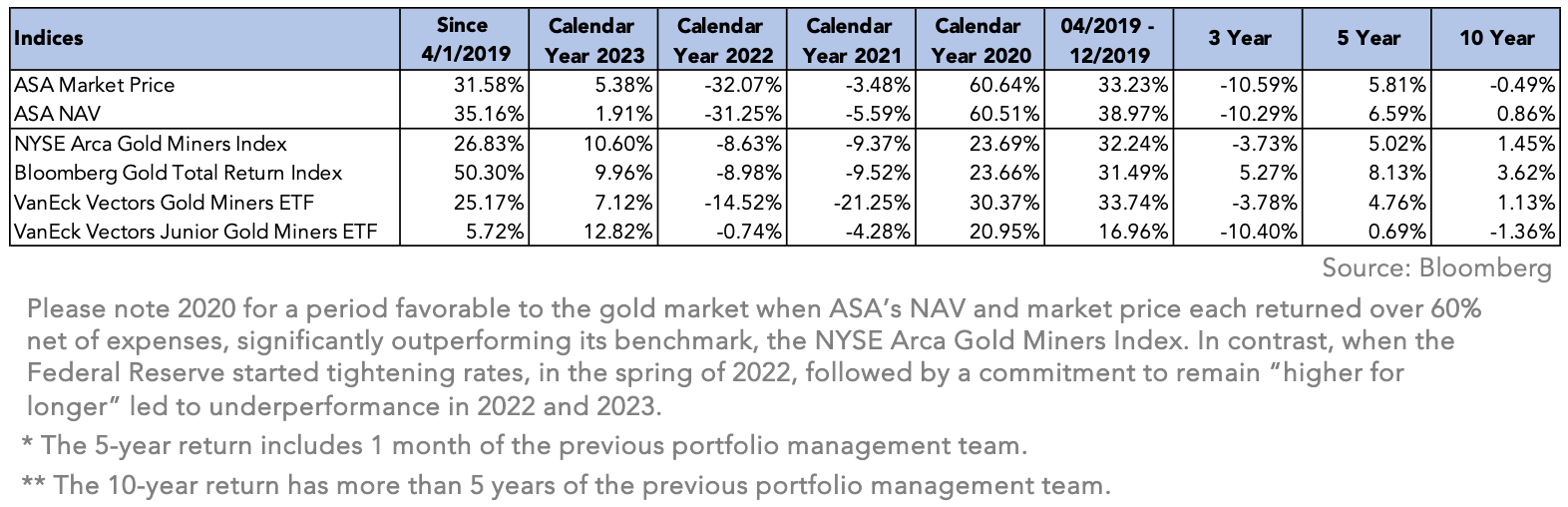

When the precious metal sector took off in late 2019 and the following year, ASA substantially outperformed. Subsequently, the Federal Reserve's "higher for longer" environment provided a headwind. Unsurprisingly, since Fed Chair Powell signaled ending "higher for longer" last fall, share prices of junior mining company share prices started performing favorably again.[1] Overall, ASA has outperformed the major gold mining ETFs since April 2019. From April 2019 through February 2024, ASA's exceeded its benchmark, the NYSE Arca Gold Miners Total Return Index (the “Index”), with the Net Asset Value (NAV) increasing 35.16% and share price increasing 31.58%. In comparison, the gold miner ETF GDX had a total return of 25.17%, and the junior gold miner ETF GDXJ had a total return of 5.72% during the same period. For completeness, see the table below.

Note: Net Asset Value (NAV) of a fund will have a slightly different performance from the share price. In ASA’s case, both NAV and share price outperformed the Index, although ASA has expenses, whereas the Index does not. As you can see from the performance of GDX versus its own underlying index (which is also the Index), fees matter.

ASA’s “junior” companies are, for the most part, much more junior than those held in GDXJ; this may account for the difference in performance during the period cited.

My point is not to brag about performance, but to illustrate the different risk/return profiles. When ASA participates in funding rounds for junior miners, the fund often gets warrants providing economic leverage if the companies succeed.

When shareholders approved Merk as the investment adviser, aside from recognizing the potential for higher returns with smaller miners, we sought to differentiate ourselves from the mutual funds and ETFs in the space. If we implemented a strategy possible in an open-end structure, why have the closed-end fund in the first place, with its lack of daily redemptions, shares typically trading at a discount and often at higher cost than a mutual fund? We embrace the closed-end fund structure because it allows for a strategy unavailable through mutual funds or ETFs.

ASA occupies an important position in the precious metals ecosystem. ASA bridges the gap between seed stage investors and institutional investors. I argue that the precious metals mining industry benefits from ASA’s strategy because we help shepherd companies to a point where they become an appropriate investment for larger institutional investors, or acquisition targets for larger companies. That’s why, even if you are not an ASA investor, you may well have a stake in ASA’s future.

Closed-end fund discounts

From our conversations with ASA investors and market analysis we can say:

- Buying gold mining companies at a discount is attractive to some investors.

- Some closed-end fund investors are less interested in what ASA invests in, more so that the NAV discount in the market varies. They might buy shares in ASA when the discount is larger and sell when it is smaller.

- And then there’s the activist investor that wants to force a corporate action to “capture” the discount.

A conundrum in the closed-end fund space is that while you can buy the shares typically at a discount, odds are that you will again sell them at a discount down the road, although if you time it right, the discount might be less (and on rare occasion, some closed-end funds trade at a premium). That is, unless some corporate action is taken to eliminate the discount. However, we wanted to clarify a few potential points of misunderstanding on this topic:

- First, discounts are common for most closed-end funds. Shares trade separately from the fund's NAV in the stock market. Many factors contribute to a fund's discount.

- Any investor who does not like a discount from NAV can choose not to buy closed-end fund shares.

- It is not the duty of closed-end fund boards or advisers to lower discounts. ASA’s investment objective and strategy say nothing about the discount. If there were a fiduciary duty to eliminate the discount, closed-end funds would not exist.

Saba is an activist that historically has a strategy of buying shares at a discount and then seeking action to get out of its investment at a profit by seeking fundamental change in its target. Saba argues that the discount in ASA is significant due to “poor performance”. That’s a great soundbite, except it’s wrong and in my assessment misleading as over time performance is actually better than the Index. (You can find periods where ASA underperformed as well – I mentioned the Fed’s “higher for longer” environment was a headwind.) What's important for any strategy is that it does what it says: investors decide if they like it before they buy fund shares. Merk communicates that ASA invests in junior mining companies, executes that strategy, and performance is consistent with ASA’s strategy, including outperforming some other funds focused on that segment. Saba should not mislead shareholders regarding the Fund’s performance in its efforts to take over ASA.

Saba’s cookie cutter causing cookies to crumble?

Saba boasts running 64 campaigns in 2023. When running that many campaigns, unsurprisingly, you may be tempted to use a cookie cutter approach. Indeed, Saba’s arguments use boilerplate language that can be found in their other campaigns. However, Saba’s cookie cutter approach may be detrimental to ASA:

- Saba advocates tender offers. Tender offers could trigger forced sales of assets. With a large portion of illiquid assets, a tender offer announcement might put pressure on fund holdings as other market participants sell in front of the event, harming shareholder value. There are also standard tender offer effects, including spreading the fund's fixed costs to remaining investors as returning capital to some investors shrinks the asset base but costs remain. This increases costs per asset, potentially risking ASA's long-term viability. Notably, tender offers don't "fix" discounts. They might temporarily reduce them prior to the tender, but typically discounts return after execution. ASA is at a reasonable size now, but if it shrinks substantially from a tender offer the fund may not remain viable.

- At times, Saba has advocated paying high dividends. However, dividends may not significantly (or not at all) reduce the stock price discount. Dividends may be a reasonable approach when underlying portfolio holdings pay dividends, not the case with ASA. Dividends can raise concerns about selling assets, especially less liquid holdings. Separately, we can’t give tax advice, but shareholders should check with their CPA about implications of ASA switching to a high dividend strategy.

- To facilitate a high dividend strategy, Saba has employed leverage at times. Given ASA’s already high share price volatility, we do not think investors would appreciate adding leverage. Some closed end funds do embrace leverage, most typically fixed income funds and some funds offering preferred shares; ASA has not done this and would only consider it if suggested by a strong majority of shareholders, as leverage would cause fundamental change for ASA’s strategy.

- Saba’s Weinstein at times quips that fund boards merely need to “snap with their fingers” to convert a closed-end fund to an open-end fund. In ASA’s case, not so fast. I have already pointed out that the fund’s strategy of investing in junior mining companies could not be pursued in an open-end fund due to the liquidity considerations. Also, we don’t think the SEC is likely to allow ASA to convert to an open-end structure because of its Bermuda status. In the 1980s, when some European fund complexes tried to offer their funds in the U.S., the industry protested; the process was long and expensive with the result being the applicants gave up. We believe that ASA would spend a lot of shareholder money if this attempt were made again, quite likely with the same result.

- Saba writes in its proxy statement regarding the “ideas” a new manager could bring (without stating that the advisory contract provides no obligation for the manager to lower the discount): “Such measures may include an increase and change in marketing and related efforts, improving corporate governance, seeking out additional potential new buyers for the Fund’s shares, repurchasing the Fund’s shares, changing the Fund’s investment mandate and/or changing the investment team.” – Let’s look at this more closely:

- “an increase and change in marketing and related efforts” -- Merk, already pursues periodic webinars, chart books, newsletters, to name a selection of our strong communications outreach to inform ASA’s investors.

- “improving corporate governance” – when Saba talks about “corporate governance” we believe they are thinking of a tender offer or high dividend program. That’s self serving and in our view not a proper definition of good governance. Good governance examples in ASA’s case include:

- A Board with deep expertise in precious metals, finance, fund oversight and fund regulation.

- A Board that facilitated a transition from weekly to daily NAV pricing in 2019.

- A Board that transitioned to an external management team to achieve more depth and to a lower variable cost model

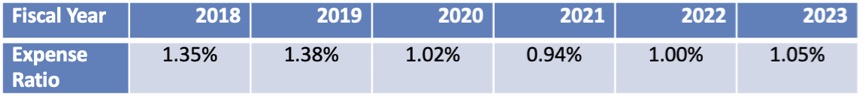

- A cost-conscious Board as keeping expenses low is one of the better ways a Board can reward long-term investors. Despite a high-cost environment the Board has managed to lower costs:

- The Board and Merk agreeing on a voluntary partial waiver of management fees above US$300mm.

- “changing the Fund’s investment mandate and/or changing the investment team” – here is where Saba lets the cat out of the bag: that a change in management team may very well mean making Saba the Fund’s manager. If you are still not convinced, look further in their proxy statement: “Saba Capital … may … offer its services to the Board to act as an interim or long-term manager to the Fund”. Now if you haven’t heard of Saba Capital as a precious metals fund manager, you’ve heard right – they have no experience in managing a precious metals fund; “changing the Fund’s investment mandate” is part of their toolbox. And this isn’t just theoretical, Saba has done just that – not to precious metals funds – but to other closed end funds, repurposing them and becoming the manager.

Despite Saba’s statements to the contrary, I believe Saba pursues these tactics because doing so is in its own self interest. However, Saba’s suggested changes are not in the interests of ASA investors and ASA portfolio companies.

You can help the precious metals sector by helping ASA

If you are an ASA shareholder and held shares on the record date of January 19th, we urge you to vote the “WHITE” card. Notably, we urge you to vote in favor of all proposals. Most importantly, please vote in favor of each of the existing Board members – we must send Saba a clear message. Just as importantly, do not

vote Saba’s proxy card; if you do, it will cancel your WHITE card vote. If voting electronically, vote the management proxy, not Saba's. Whichever you vote last will count. The shareholder meeting is on April 26, 2024, but don’t wait, as sending a message now is important. It doesn’t matter whether you own one share or 10,000 shares or more – your vote is important. And to be clear, I eat my own pudding: I am on the record as an insider buyer and own over 120,000 shares with my wife.

If you're not an ASA shareholder, should you become one? We're not here to pitch buying a stock; you must determine if ASA is suitable without our guidance. If buying shares now, you cannot vote at this annual meeting, but since Saba doesn't necessarily walk away when losing, your vote will count in future important meetings.

Beyond shareholder support, you can help spread the word. There is so much misinformation out there and it’s important to set the record straight. It’s important to tell the precious metals investment community that this is bigger than ASA. (Indeed the entire closed end fund universe is at risk due to Saba’s tactics.) Tell your favorite podcast and YouTube host to have someone from Merk as a guest. If reading an article discussing gold miners or the closed-end fund space, reach out to the journalist to contact me. Do your part to spread the word in your circle of influence, not matter how small. It makes a difference and is greatly appreciated.

I’ll gladly follow up with anyone who has questions – please reach out to me at merkinvestments.com/contact. We are eager to talk directly to investors and followers of our work.

Axel Merk

President and CIO, Merk Investments

[1] Junior mining stocks are small, early-stage mining companies that are typically still in the exploration and development phase and have yet to mine any resources.

This report was prepared by Merk Investments LLC (“Merk Investments”),and reflects the current opinion of the authors. It is based upon sources and data believed to be accurate and reliable. Merk Investments makes no representation regarding the advisability of investing in the products herein. The information contained herein reflects Merk Investments’ current views and opinions with respect to, among other things, future events and financial performance. Charts, graphs, and tables are provided for illustrative purposes only. Any forward-looking statements contained herein are based on current estimates and expectations. Opinions and forward-looking statements expressed are subject to change without notice. This information does not constitute investment advice and is not intended as an endorsement of any specific investment. The information contained herein is general in nature and is provided solely for educational and informational purposes. Some believe predicting recessions is either impossible or very difficult. The information provided does not constitute legal, financial or tax advice. You should obtain advice specific to your circumstances from your own legal, financial and tax advisors. Past performance is no guarantee of future results.

Forward-Looking Statements pertaining to ASA Gold & Precious Metals Ltd. (the "Company")

This presentation includes forward-looking statements within the meaning of U.S. federal securities laws. The Company’s actual performance or results may differ from its beliefs, expectations, estimates, goals and projections, and consequently, investors should not rely on these forward-looking statements as predictions of future events. Forward-looking statements are not historical in nature and generally can be identified by words such as “believe,” “anticipate,” “estimate,” “expect,” “intend,” “should,” “may,” “will,” “seek,” or similar expressions or their negative forms, or by references to strategy, plans, goals or intentions. The absence of these words or references does not mean that the statements are not forward-looking. The Company’s performance or results can fluctuate from month to month depending on a variety of factors, a number of which are beyond the Company’s control and/or are difficult to predict, including without limitation: the Company’s investment decisions, the performance of the securities in its investment portfolio, economic, political, market and financial factors, and the prices of gold, platinum and other precious minerals that may fluctuate substantially over short periods of time. The Company may or may not revise, correct or update the forward-looking statements as a result of new information, future events or otherwise.

The Company concentrates its investments in the gold and precious minerals sector. This sector may be more volatile than other industries and may be affected by movements in commodity prices triggered by international monetary and political developments. The Company is a non-diversified fund and, as such, may invest in fewer investments than that of a diversified portfolio. The Company may invest in smaller-sized companies that may be more volatile and less liquid than larger more established companies. Investments in foreign securities, especially those in the emerging markets, may involve increased risk as well as exposure to currency fluctuations. Shares of closed-end funds frequently trade at a discount to net asset value. All performance information reflects past performance and is presented on a total return basis. Past performance is no guarantee of future results. Current performance may differ from the performance shown.

This letter does not constitute an offer to sell or solicitation of an offer to buy any securities.

Become a Part of the Merk Community

Subscribe to our regular reports and research, as well as all updates relating to MERK

We adhere to a strict Privacy Policy governing the handling of your information. Opt-out any time.

thoroughly researched perspectives on the trends shaping global markets.

topics may span disruptive tech, income strategies & emerging economies.

27.6k subscribers