Saba’s Siren Song Risks Dismantling Mining Fund

Mar 18, 2024

Insights

Axel Merk

Axel Merk

I'm passionate about Fed policy, fiscal policy, and cautioning against Saba's siren song. What do they have in common? Throughout my life, when faced with potentially harmful policies or actions, I've been motivated to speak up and act, creating products to empower investors. Seeing Saba potentially mislead investors, with implications not just for NYSE:ASA, the closed-end mining fund we manage, but for the entire mining industry, I cannot stay silent.

Saba's siren song: Alluring promises, but misleading?

Saba recently sent ASA investors a letter stating, “Eliminating the Fund’s discount would generate a 20% gain for shareholders. Saba’s nominees have been successful in reducing discounts in dozens of similar situations.” Despite the fact that Saba is an SEC-registered investment adviser and has a duty not to mislead clients or investors, such statements by Saba give investors the false impression that they could be in for a quick buck, making a 20% gain if investors only vote for Saba’s director nominees. However, they offer no factual support for these types of claims.

What’s going on is hiding in plain sight. First, for context, closed-end funds like ASA trade on the NYSE based on supply and demand and, unlike ETFs, do not have an automatic arbitrage mechanism that have ETFs trade at net asset value (NAV). More on that below, but first. Let’s dig into Saba’s statements.

- "Eliminating the Fund’s discount would generate a 20% gain for shareholders."

That’s technically correct, well almost – they are rounding up. What they don’t write is that this is subject to what we believe to be unrealistic assumptions, plenty of risks (something Saba in our assessment is obligated to disclose but opted not to) and, as such is misleading. Hold on for more context.

- "Saba’s nominees have been successful in reducing discounts in dozens of similar situations."

Pay attention to the wording: Saba has been successful in reducing discounts…not eliminating them. Saba is not promising the 20% gain it implies. Moreover, Saba has not achieved this reduction in a fund like ASA, which holds over 70% of its assets in relatively illiquid small-cap stocks, convertible notes, and private equity.

Tender offers: Saba’s “fix” may not be suitable for ASA

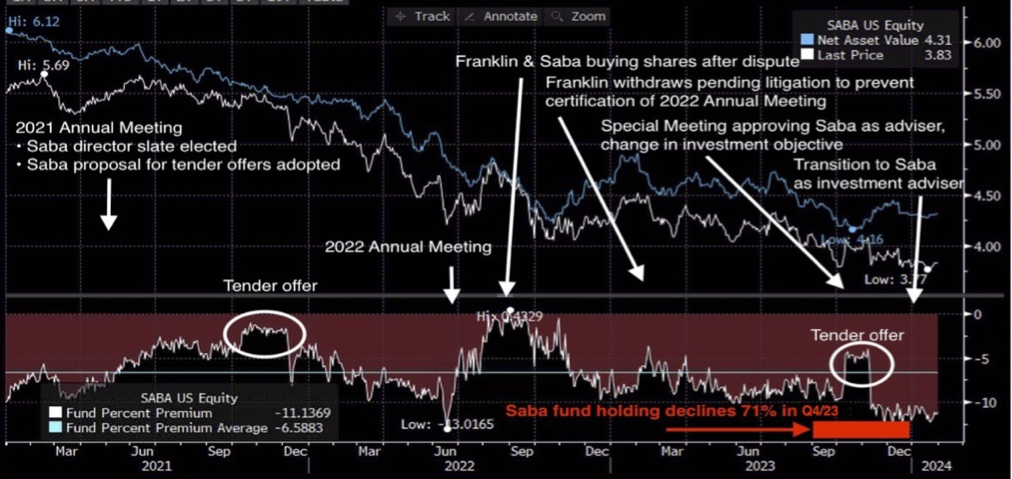

It is correct that Saba has been “successful”, at least in seizing control. An illustrative example is the Templeton Global Income Fund, once trading under the symbol GIM, now managed by Saba under the symbol, take a guess, NYSE:SABA. In particular, note the two circles showing tender offers that temporarily reduced the fund’s discount (Saba omitted “temporary” in their pitch) (chart: Jan 2021 – Jan 2024, source: Bloomberg):

Also note that after Saba became the manager of Templeton Global Income Fund and generated a perpetual income stream for itself (through management fees), Saba lowered its stake in the fund by 71% in Q4 2023 alone (chart Jan 2021 – Jan 2024, source: Bloomberg):

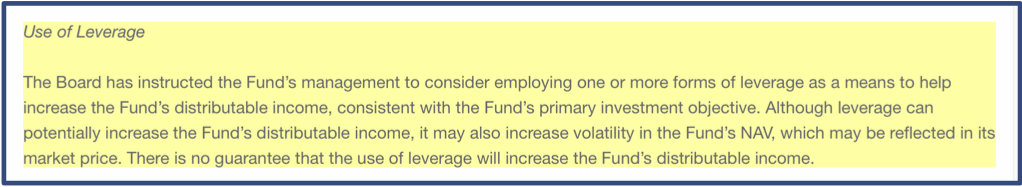

But, hey, those who participated in the tender offer did indeed capture some of the discount, isn’t that great? If you are inclined to think so, please pause a moment and think this through. To assist in this process, may I point your attention to a disclosure Saba gave in a March 2021 press release:

Now, let’s think about the implications for ASA, should Saba’s approach be deployed.

- ASA invests in gold mining companies – anyone who has invested in that space knows it is volatile.

- ASA currently invests greater than 70% in small cap companies which tend to be exploration and development companies – anyone who has invested in these knows they are more volatile than producers you see in the large ETFs.

- When ASA helps finance small mining companies, the fund often receives warrants. Warrants can be a win for both the fund and the companies as they provide economic leverage to the fund when warrants are in the money while providing the companies with additional funding should the warrants get exercised.

If there’s a common theme here: ASA is plenty volatile. If you were to have a tender offer to allow some investors to capture some of the discount without selling holdings, but by introducing leverage, it would – in the humble opinion of portfolio management – add irresponsible additional risks. In our observation, many retail long-term investors are less likely to participate in tender offers, leaving them with a more volatile fund and fixed costs spread across fewer investors.

So why not simply sell some holdings to facilitate a tender offer and make Saba happy? We publish ASA’s holdings monthly. Take a moment to go through them and look up just how illiquid these holdings are. Given the market’s forward-looking nature, even just announcing a tender offer might very well exert downward pressure on ASA’s holdings, penalizing all ASA shareholders. For any tender, costs are involved, both external, such as legal, and internal, such as commissions and foregone opportunity with respect to securities that must be sold to finance the tender, leaving a reduced asset base.In our assessment, Saba is playing with fire because it doesn’t understand that its cookie cutter playbook may not be suitable for ASA.

ASA’s strategy is focused on these smaller firms, in-part because we believe they have tremendous potential, and we provide investments not available in ETFs or open-end funds. You wouldn’t need a closed-end fund structure if the fund were index-hugging. In a closed-end fund, we can invest in these earlier stage mining companies, and through that provide a vehicle to give investors access to deals that they otherwise would not have. Yes, there’s a price to pay, notably that ASA has historically traded at a discount. Please keep in mind that ASA was founded in 1958 and most current shareholders are likely to have initially bought at a discount, so they are likely not losing money if they one day sell at a discount.

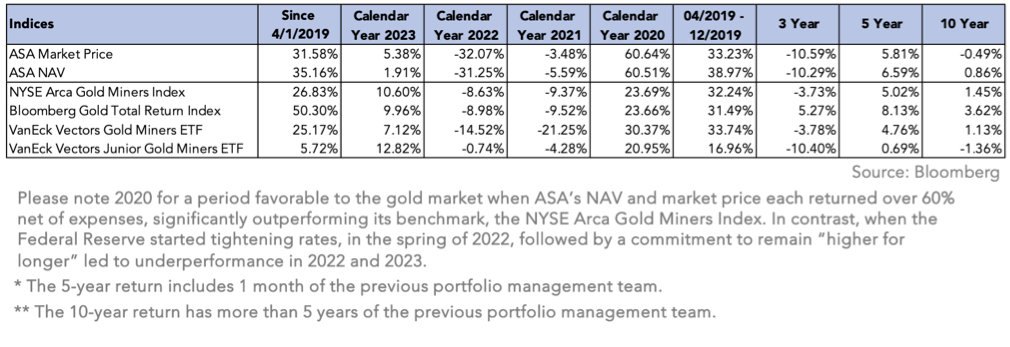

ASA’s performance

Let me take a moment to address another one of Saba’s misleading statements. In Saba’s proxy statement, it suggests that ASA’s discount is due to “poor performance”. This statement is wrong on two accounts: From the time that Merk began managing the fund in April 2019[1] through February 2024, ASA’s performance has outperformed its benchmark, the NYSE Gold Miners Total Return Index, and the well-known ETFs GDX and GDXJ.

ASA’s discount

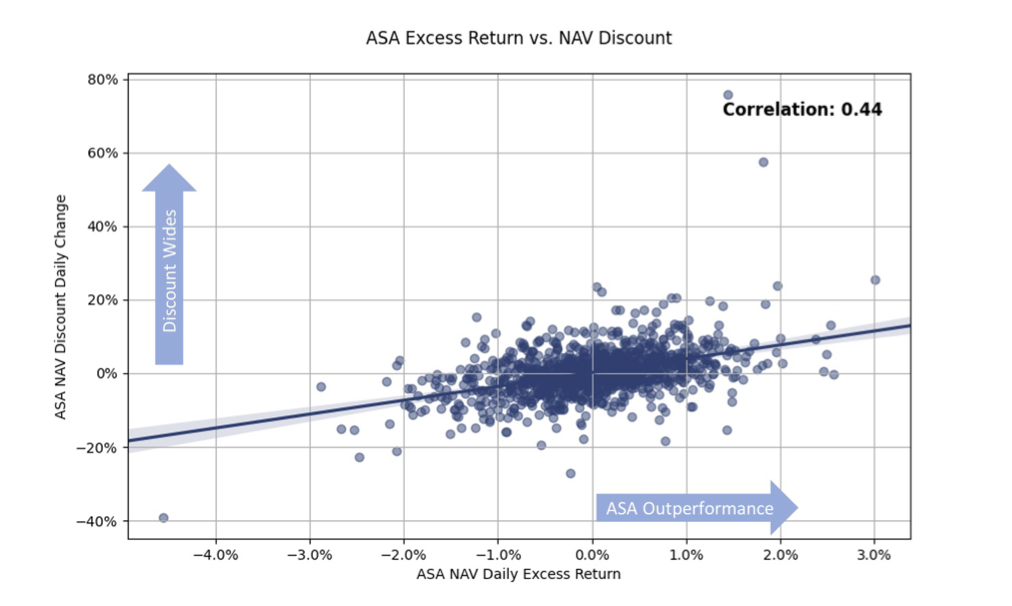

Maybe just as relevant, Saba’s claim that poor performance leads to a greater discount is an incomplete story. When you look at the data, periods of outperformance of ASA’s benchmark are associated with widening discounts and, vice versa, periods of under-performance are associated with smaller discounts (data in the chart 4/1/2019 through 12/31/2023, source Bloomberg, Merk):

How can that be? Quite simply, the market takes time to catch-up to portfolio performance, in addition to incorporating other factors.

In contrast, Saba looks at the issue backwards, focusing only on the share price. Granted, the share price is relevant to investors, but the share price is out of the control of the adviser and fund board. The share price of a closed-end fund is driven by supply and demand. Our internal analysis has shown that there’s a relationship between real interest rates and ASA’s share price – meaning a factor that influences the price of gold and gold miners impacts interest in ASA. In our recent analysis, I write more about what we do to inform the market and potentially help reduce the discount, including active communication / transparency etc., but it is ultimately up to the market.

Finally, Saba complains that the fund is spending money to defend itself. As one of the largest individual shareholders and a director of ASA, I am also concerned about fund expenses. The good news is that ASA’s Board has been able to get expenses under control due to prudent measures taken in recent years. Below are the fund’s expense ratios for recent fiscal years:

Despite numerous attempts to engage Saba in a constructive dialogue over the past year, they only communicated to us that they are “following their investment process.” ASA’s Board is faced with a shareholder will not engage. Saba appeared to be seeking creeping control of ASA without paying a control premium or otherwise assuring us that its goals were consistent with ASA’s investment objective and the interests of shareholders as a whole. The Board seeks to act in the interests of ASA and allow the voices of all shareholders to be heard. There’s a cost associated with that, which would have been avoidable had Saba constructively engaged with ASA as we requested on a number of occasions.

To take this a step further, if Saba succeeds and replaces the current Board with its own handpicked nominees, institutional knowledge will be lost and there may be significant additional costs incurred just for Saba and its nominees to learn about the unique aspects of ASA and oversee the fund, let alone the costs that would be incurred in order for Saba and its nominees to attempt to implement the changes they’ve promised. I didn’t expand on it today, but ASA is incorporated in Bermuda which creates another layer of complexity (read: cost) for anyone trying to change the fund.

Support ASA

If you are a shareholder and want ASA to remain a mining fund that also invests in exploration and development companies, we urge you to vote in favor of all of ASA’s director nominees and all other proposals using the “WHITE” proxy card. Just as importantly, do not vote Saba’s proxy card; if you do, it will cancel your WHITE card vote. If voting electronically, vote the management proxy, not Saba's. Whichever you vote last will count. The shareholder meeting is on April 26, 2024, but don’t wait, as sending a message now is important.

I’ll gladly follow up with anyone who has questions – please reach out to me at merkinvestments.com/contact. We are eager to talk directly to investors and followers of our work.

Axel Merk

President and CIO, Merk Investments

[1] Peter Maletis started managing ASA on April 1, 2019. On April 12, 2019, ASA shareholders approved Merk Investments as ASA’s investment manager. On April 1, 2022, Jamie Holman joined the ASA portfolio management team at Merk Investments.

This report was prepared by Merk Investments LLC (“Merk Investments”),and reflects the current opinion of the authors. It is based upon sources and data believed to be accurate and reliable. Merk Investments makes no representation regarding the advisability of investing in the products herein. The information contained herein reflects Merk Investments’ current views and opinions with respect to, among other things, future events and financial performance. Charts, graphs, and tables are provided for illustrative purposes only. Any forward-looking statements contained herein are based on current estimates and expectations. Opinions and forward-looking statements expressed are subject to change without notice. This information does not constitute investment advice and is not intended as an endorsement of any specific investment. The information contained herein is general in nature and is provided solely for educational and informational purposes. Some believe predicting recessions is either impossible or very difficult. The information provided does not constitute legal, financial or tax advice. You should obtain advice specific to your circumstances from your own legal, financial and tax advisors. Past performance is no guarantee of future results.

Forward-Looking Statements pertaining to ASA Gold & Precious Metals Ltd. (the "Company")

This presentation includes forward-looking statements within the meaning of U.S. federal securities laws. The Company’s actual performance or results may differ from its beliefs, expectations, estimates, goals and projections, and consequently, investors should not rely on these forward-looking statements as predictions of future events. Forward-looking statements are not historical in nature and generally can be identified by words such as “believe,” “anticipate,” “estimate,” “expect,” “intend,” “should,” “may,” “will,” “seek,” or similar expressions or their negative forms, or by references to strategy, plans, goals or intentions. The absence of these words or references does not mean that the statements are not forward-looking. The Company’s performance or results can fluctuate from month to month depending on a variety of factors, a number of which are beyond the Company’s control and/or are difficult to predict, including without limitation: the Company’s investment decisions, the performance of the securities in its investment portfolio, economic, political, market and financial factors, and the prices of gold, platinum and other precious minerals that may fluctuate substantially over short periods of time. The Company may or may not revise, correct or update the forward-looking statements as a result of new information, future events or otherwise.

The Company concentrates its investments in the gold and precious minerals sector. This sector may be more volatile than other industries and may be affected by movements in commodity prices triggered by international monetary and political developments. The Company is a non-diversified fund and, as such, may invest in fewer investments than that of a diversified portfolio. The Company may invest in smaller-sized companies that may be more volatile and less liquid than larger more established companies. Investments in foreign securities, especially those in the emerging markets, may involve increased risk as well as exposure to currency fluctuations. Shares of closed-end funds frequently trade at a discount to net asset value. All performance information reflects past performance and is presented on a total return basis. Past performance is no guarantee of future results. Current performance may differ from the performance shown.

This letter does not constitute an offer to sell or solicitation of an offer to buy any securities.

Become a Part of the Merk Community

Subscribe to our regular reports and research, as well as all updates relating to MERK

We adhere to a strict Privacy Policy governing the handling of your information. Opt-out any time.

thoroughly researched perspectives on the trends shaping global markets.

topics may span disruptive tech, income strategies & emerging economies.

27.6k subscribers