|

Why does the value of the U.S. Dollar matter to me?

Are U.S. deficits sustainable?

Why does the current account deficit pose a risk to the dollar?

What is sound monetary policy and what is the impact on currencies?

What is the outlook for the Chinese renminbi?

Where to find value in emerging market currencies?

|

Why does the value of the U.S. Dollar matter to me?

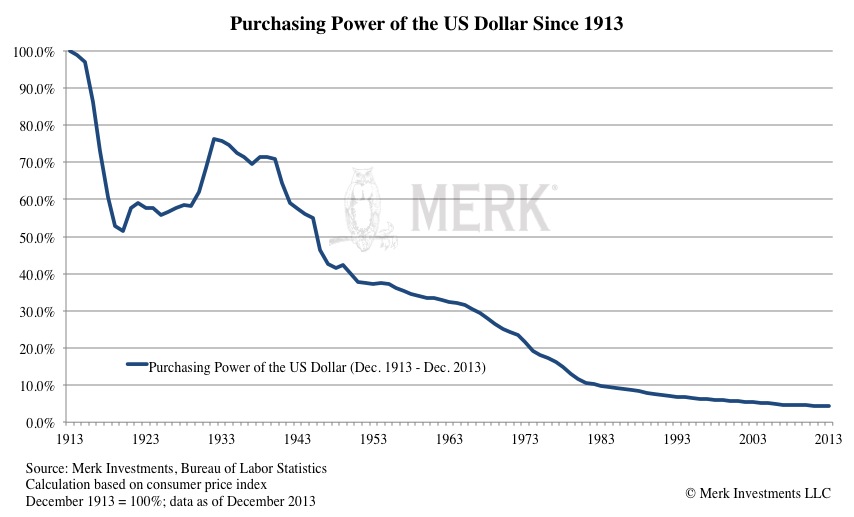

Consider the dollar's purchasing power, or how much in terms of goods or services a dollar can buy at a given time. As illustrated in the chart below, the dollar has lost more than 95% of its purchasing power since the creation of the Federal Reserve in 1913, as adjusted by the official consumer price index (CPI). In other words, goods and services you could buy with less than $5 in 1913 would cost you $100 in today’s dollar.

Here's another way to look at the value of the greenback: a night in a hotel in Europe on October 25, 2000 charging €100 would have cost you less than $83; the same hotel, had it kept its price unchanged at €100, would have cost you over $137 on January 1, 2014 – more than a 65% cost increase in U.S. dollar terms.*

You may not care much about the cost of a hotel in Europe if most of your expenses are in U.S. dollars and inflation has been tame over the past couple of years. However, if a currency loses value relative to other currencies, this may compound inflationary pressures, as imports become more expensive. Even if you personally don’t buy anything directly from abroad, U.S. corporations import a great deal. As imported goods get more expensive, production costs go up. As cost pressures rise, corporations are more likely to pass on cost increases to you and me, the consumers. Moreover, if you are a shareholder in such a company, these cost pressures can have a marked effect on the company’s bottom line, negatively affecting the share price and your investment holdings. Clearly, the U.S. dollar can have large implications on corporate profitability and indirectly on you and your investments.

To learn more and receive articles and commentaries on events that may impact your portfolio decisions as they occur, please subscribe to Merk Insights, our free newsletter:

*Source: Bloomberg. On October 25, 2000, when the Euro was at its historic low, you needed U.S.$0.8272 to buy 1 Euro. On January 1, 2014, U.S. $1.3763 were needed to buy 1 Euro.

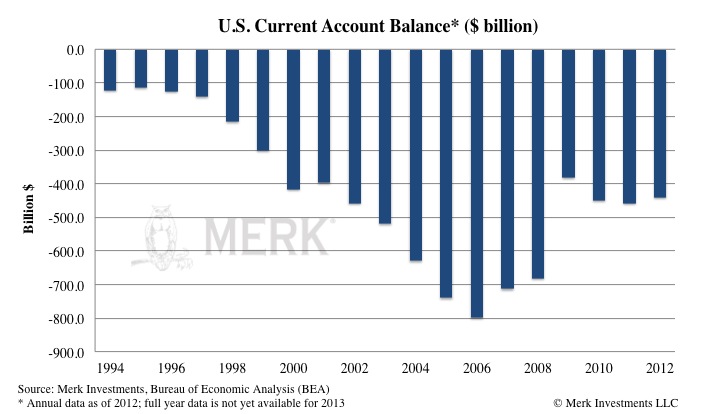

The balance on trade (the difference between exports and imports of goods and services) is the largest driver of the U.S. current account deficit. In our assessment, the narrowing of the deficit in 2009 was attributed to a weak U.S. economy and consumer, rather than the strength of the U.S. export sector – in fact, the economic downturn caused both exports and imports to fall, it’s just that the rate of decline was more pronounced for imports given the weakness of the U.S. consumer. To put the present current account deficit into perspective, the net shortfall between what the U.S. earned and what the U.S. paid in 2010 was $470.9 billion. Another way to look at this number is that foreigners had to purchase nearly $2 billion worth of U.S. denominated assets (such as U.S. Treasuries) every single business day just to keep the U.S. dollar from falling.

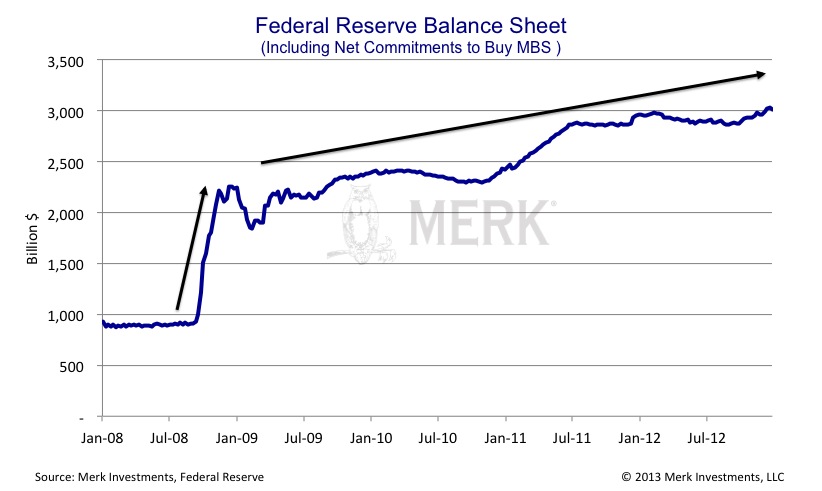

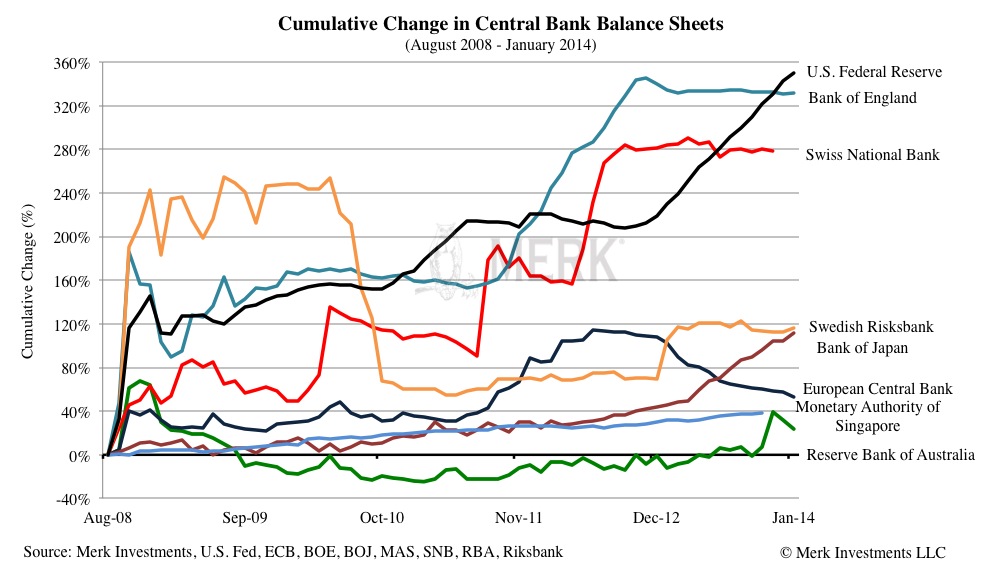

Additionally, we believe the Federal Reserve’s (Fed) actions will likely result in continued devaluation of the U.S. dollar. When a central bank substantially increases the money supply, all else held equal, the central bank causes inflation, a devaluation of the currency’s purchasing power. The Fed has been one of the more prolific money printing central banks around the world, increasing its balance sheet more than threefold since the beginning of the global credit crisis (in simple terms, a central bank’s balance sheet can be thought of as money that has been printed). In our opinion, there is a significant divergence in monetary policies around the world, with the majority of other central banks not following such easy monetary policies relative to the Fed. In contrast to the Fed, other central banks appear more reticent to conduct quantitative easing or implement other "non-standard" monetary policy measures. The composition of the Fed’s balance sheet also gives us cause for concern: in our view, the massive amount of agency mortgage backed securities (MBS) the Fed has purchased will create extreme levels of inflexibility on the Fed’s balance should inflation break out, reducing the Fed’s ability to counteract such an occurrence. Furthermore, the Fed's large-scale purchases of long-term Treasuries creates disruptions regarding key metrics of market ascribed economic forecasts, potentially hampering the effectiveness of monetary policy. Additionally, the Fed's purchases intentionally overvalue those same securities, incentivizing rational investors to look elsewhere for less manipulated returns, putting further downward pressure on the U.S. dollar.

While we see considerable risks domestically, we believe there are attractive international investment opportunities. On a long-term view, we anticipate that Asia may outpace most western economies, including the U.S., attracting global investment and putting upward pressure on the value of many Asian currencies. Many Asian nations have substantial surpluses and much healthier fiscal positions than the U.S. Moreover, most countries in the region have focused on growing their domestic economies, spending on the likes of infrastructure, growing the middle class and urbanizing the workforce. A likely side effect of such rapid domestic growth may be increased inflationary pressures. In our view, allowing these currencies to appreciate may be an effective way to address and mitigate domestic inflationary concerns. As such, inflationary pressures may force the hand of Asian countries following tightly managed exchange rate policies, such as China, to allow their currencies to appreciate.

Strong, ongoing Asian economic growth will likely sustain the demand for commodities and natural resources. Countries rich in such resources may fare well, and ongoing Asian demand will likely benefit the currencies of such nations over the long-term. We consider that countries whose governments display greater fiscal restraint and responsibility will increasingly be viewed as sought after sources of stability; over time such countries may supplant the U.S. as safe haven investments. Additionally, in our assessment, the monetary policies pursued by central banks globally will have a marked impact on currency valuations over the long-term. Relative to the Fed, we believe many international central banks are more effectively fostering an environment of price stability and as such, the currencies of such nations may retain significant value relative to the U.S. dollar. Consequently, on a long-term view, we favor the currencies of nations that are well placed to benefit from ongoing Asian economic growth, display fiscal restraint, and whose central banks’ pursue prudent monetary policies.

Why does the current account deficit pose a risk to the dollar?

When explaining the risk in the U.S. dollar we take a look at the big picture. We analyze large forces that have weighed on the markets, and in particular, have impacted the value of the U.S. dollar.

One of the major factors we focus on is the current account deficit. The current account balance is what the U.S. earns from other countries (for exports, services, and investments made abroad) less what the U.S. pays to other countries (for imports, services, loans).

The size of the U.S. current account deficit has grown significantly over the past two decades, and structurally remains at unsustainable levels. To put the present current account deficit into perspective, the net shortfalls between what the U.S. earned and what the U.S. paid were $440.4 billion in 2012 and $296.3 billion in the first three quarters of 2013. Another way to think of this deficit is that foreigners had to buy over $1 billion worth of U.S. dollar denominated assets every single business day just to keep the U.S. dollar from falling relative to foreign currencies.

In our opinion, this structural deficit has been a key contributing factor to the U.S. dollar weakness. Moreover, higher economic growth rates and more attractive investment opportunities are likely to be found outside the U.S., attracting capital to such regions. All of which does not bode well for the value of the U.S. dollar. We believe considerable risks remain on a long-term basis.

To learn more and receive articles and commentaries on events that may impact your portfolio decisions as they occur, please subscribe to Merk Insights, our free newsletter:

Are U.S. deficits sustainable?

The recent financial crisis has in many ways exacerbated the global imbalances that concerned us leading into the crisis. We believe the U.S. public debt has grown out of control and is now unsustainable. Over the past five years, the U.S. debt ceiling has increased from $10 trillion to over $17 trillion. In contrast to stringent austerity measures taken by many other countries around the world, we are unlikely to see any marked improvement in public finances over the medium term. The notion of a balanced budget seems a very distant thought when overlaying the near-term outlook with the budget implications of long-term obligations, such as Medicaid, Social Security and Medicare. According the Congressional Budget Office (CBO), these "entitlement" expenses are expected to rise from 9.3% to 15.7% of GDP in the coming 35 years.

More worrying is the interest expense on public debt. As we keep piling on deficits at some point the cost of borrowing might increase to rates that are more in line with historical averages. According to the CBO, in 2048, we will be spending almost 12% of GDP on interest expense, compared to just over 1% now. Differently said, as a share of GDP, we will be paying more in 2048 for entitlements and interest expense than we currently pay for all government services combined. Said still another way, even with substantially higher taxes, there may not be any money to pay for the military, education, or infrastructure.

We think this is no longer a "long-term" problem that can be ignored. As shown in the chart below, in 10 years, annual net interest cost on public debt may rise by $1 trillion to $1.2 trillion if we go back to the historic average interest rate for financing the deficit. In other words, the "long-term" has arrived. Luckily, the CBO doesn't think we would go to such extremes as the historic average, suggesting that the cost of borrowing may "only rise" by about $700 billion to $911 billion.

Put simply, the fiscal position of the U.S. has deteriorated significantly, and we think that the outlook remains grim. We believe this situation is likely to wear away at the safe haven status the U.S. dollar has held for a long time and the value of the dollar may increasingly be at risk.

To learn more and receive articles and commentaries on events that may impact your portfolio decisions as they occur, please subscribe to Merk Insights, our free newsletter:

What is sound monetary policy and what is the impact on currencies?

We believe each respective central bank’s monetary policy has a significant impact on the overall outlook for the value of its currency. Generally speaking, we define sound monetary policy as monetary policy that focuses on long-term price stability. We believe central banks that have a strong and demonstrated commitment to fostering price stability will protect against the erosion of purchasing power of their respective currencies. Furthermore, currencies issued by such central banks should generally appreciate relative to currencies issued by central banks with a weaker commitment to price stability.

We view a currency like any other asset: logic and economic theory tells us that when the supply of an asset increases, without any offsetting shift in demand that asset should fall in value. When a central bank substantially increases the monetary base (M0) it sets the stage for a commensurate increase in the money supply (M1), and all else being equal we expect this action to naturally put downward pressure on the currency.

We view growth in a central bank’s balance sheet as a proxy for the expansion in the monetary base, which oftentimes occurs through non-standard monetary policy measures such as quantitative easing (QE). As outlined in the chart below, the Fed has been one of the most expansionary central banks in the world, increasing its balance sheet more than threefold since the beginning of the global financial crisis. In contrast, the European Central Bank’s (ECB) balance sheet has been shrinking since late 2012 as a result of early repayment of Long Term Refinancing Operations ("LTRO").

To learn more and receive articles and commentaries on events that may impact your portfolio decisions as they occur, please subscribe to Merk Insights, our free newsletter:

What is the outlook for the Chinese renminbi?

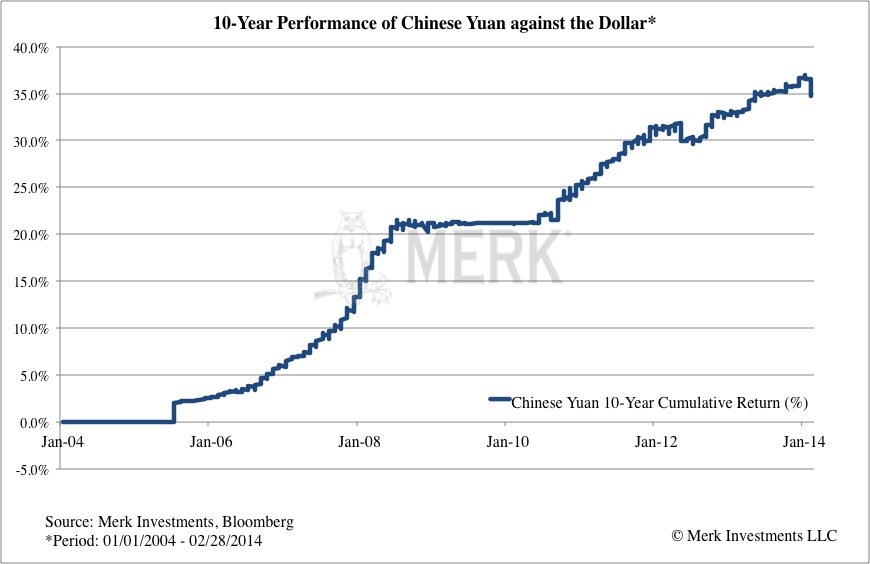

Over the past decade, the Chinese renminbi has appreciated over 35% against the U.S. dollar and hit a 20-year high against the dollar in January 2014*. Despite recent volatility, the renminbi remains one of the least volatile emerging market currencies.

Chinese policymakers have strongly signaled their intention to make the renminbi an international reserve currency, and allow greater exchange rate flexibility. We believe the recent renminbi volatility is consistent with this agenda, as policymakers intend to introduce two-way volatility to deter speculation and promote a market-based price discovery mechanism. The People's Bank of China (PBoC), the country's central bank, has widened the renminbi daily trading band from 1% to 2%. The State Administration of Foreign Exchange (SAFE), the agency managing China’s foreign exchange assets, has indicated two-way fluctuation in the exchange rate would become regular. In our view, this is a logical and necessary step for China to embrace a more flexible exchange rate regime, and it may be beneficial for the renminbi in the long run.

Over the long term, we believe the renminbi may outperform other emerging market currencies. In part we believe Chinese policymakers may continue to allow the renminbi to appreciate to help mitigate domestic inflationary pressures. More importantly, we believe the renminbi will benefit from China’s transition to a higher value added and more consumption-oriented growth model, which would include a more flexible exchange rate regime.

To learn more and receive articles and commentaries on events that may impact your portfolio decisions as they occur, please subscribe to Merk Insights, our free newsletter:

Where to find value in emerging market currencies?

The currency asset class allows investors to gain liquid* exposure to emerging market growth. Compared to emerging market equities and local debt, emerging market currencies historically exhibit lower volatility. Specifically, a pure play in emerging market currencies may provide investors with lower interest rate and credit risk than local debt exposure.

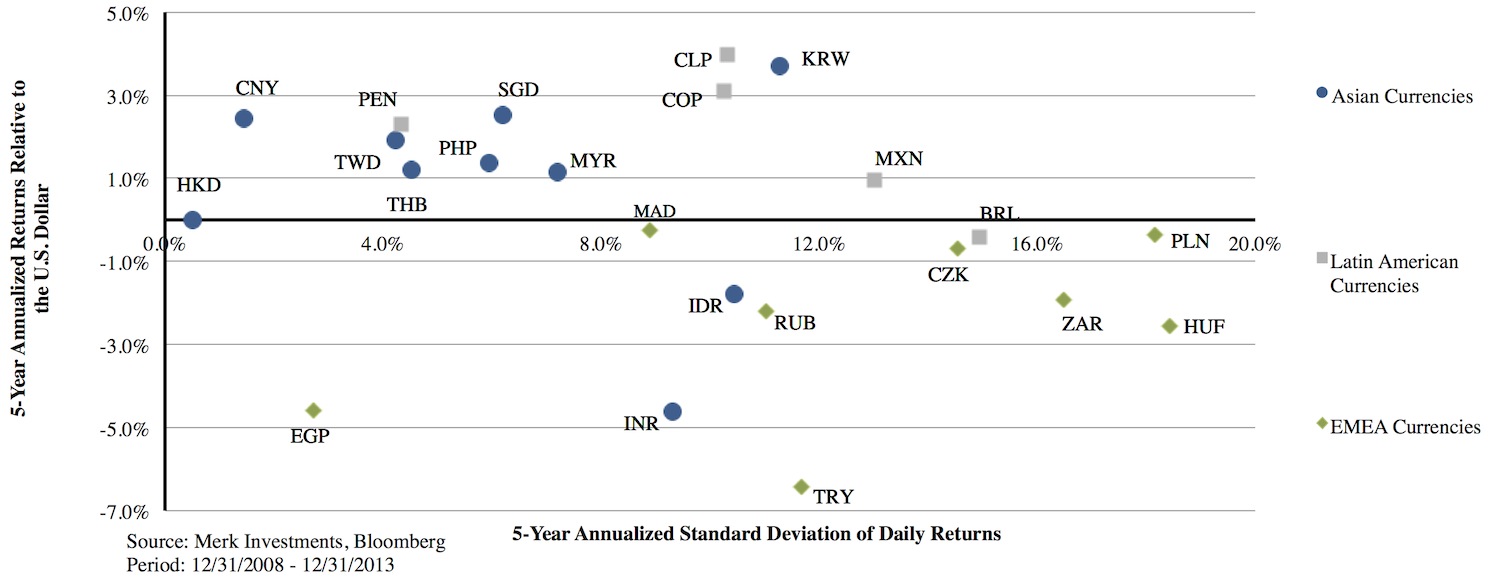

Within emerging market currencies, Asian currencies have demonstrated favorable risk-return characteristics for U.S.-based investors with low correlation to U.S. equities and U.S. fixed income. The chart below depicts the risk-return profiles of emerging market currencies for the five-year period ending December 31, 2013.

Strong economic recovery, relatively contained inflationary pressure, and higher sovereign ratings have boosted investor confidence and curbed volatility in Asian currencies. Additionally, most Asian countries are armed with stronger external positions (current account surplus and large foreign reserves), making respective currencies less vulnerable to capital outflows.

Furthermore, over the longer term, we believe Asian currencies may outperform other emerging market currencies as Asian economies are increasingly competing on value rather than price in world trade. The implication on the currency markets is that as Asian countries increasingly move up the value chain, they are less likely to rely on traditional competitive devaluation to boost their exports and are more likely to show greater tolerance of currency appreciation in the long term.

To learn more and receive articles and commentaries on events that may impact your portfolio decisions as they occur, please subscribe to Merk Insights, our free newsletter:

*Not risk-free

Currency symbols: BRL Brazilian real; CLP Chilean peso; CNY Chinese renminbi; COP Colombian peso; CZK Czech Republic koruna; EGP Egyptian pound; HKD Hong Kong dollar; HUF Hungarian forint; IDR Indonesian rupiah; INR Indian rupee; KRW South Korean won; MAD Moroccan dirham; MXN Mexican peso; MYR Malaysian ringgit; PEN Peruvian nuevo sol; PHP Philippine peso; PLN Polish zloty; RUB Russian ruble; SGD Singapore dollar; THB Thai baht; TRY Turkish lira; TWD New Taiwan dollar; ZAR South African rand. EMEA: Europe, Middle-East, and Africa.

|